Key findings

- Participant retirement preparedness is generally solid, but many participants would benefit from additional support from plan sponsors and plan advisors, with more than half of respondents expressing concerns about inflation and the economy.

- Many participants do not view themselves as experienced investors and the past few years have had mixed impact on their confidence in retirement readiness, suggesting that many would welcome reassurance and support on key topics, such as the potential benefits of their plan and support for important decisions.

- Many participants reported relatively low levels of confidence in making key decisions, particularly for decisions relating to their retirement plan and retirement income and transition services, suggesting demand for additional support.

- Participants indicated strong interest in investment education, including retirement income, managed accounts, auto features and financial wellness topics, providing opportunities to promote these services to help drive better outcomes for participants (and for sponsors). Many of these products/services help address areas in which participants cited low levels of confidence.

- Many participants haven’t decided on their retirement date (especially those over age 50), possibly due to decreased confidence in meeting their retirement goals given high inflation and concerns about insufficient savings. About 40% of participants said they aren’t sure about their plans for their retirement assets after they retire.

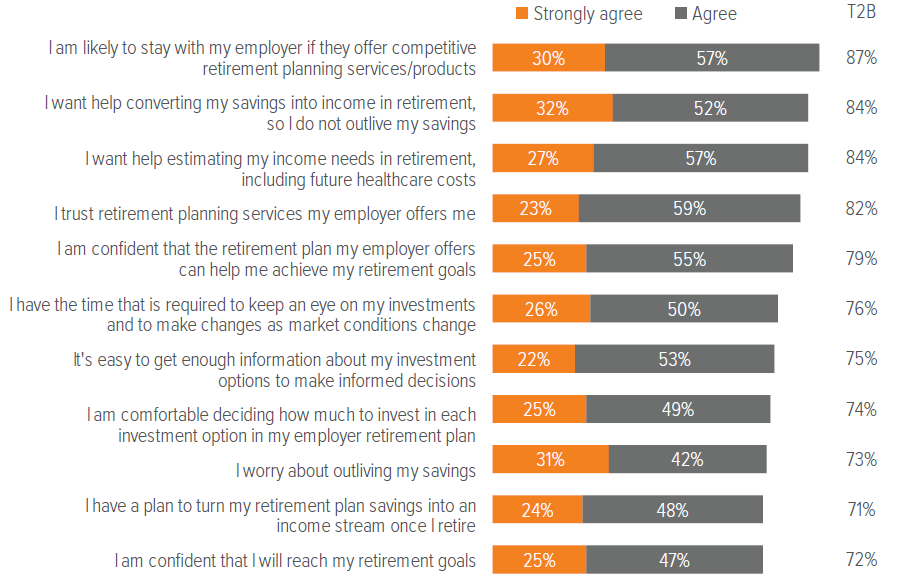

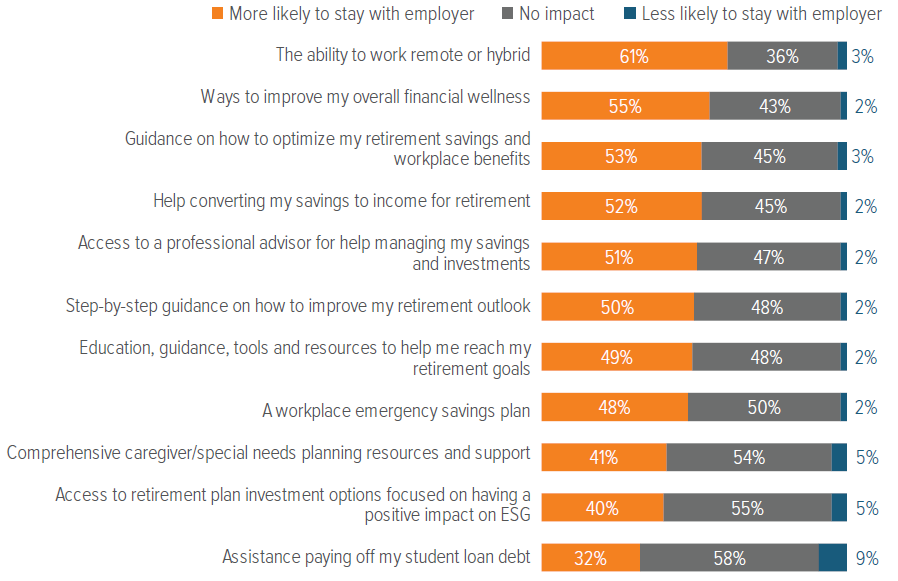

- Participants generally view their employers as a trusted source and value their employer-sponsored retirement plan (ESRP). There is an opportunity for employers/sponsors to retain employees by offering services/support in some key areas, including improving overall financial wellness, support for key decisions and retirement income planning and, to a lesser extent, ESG investment options.

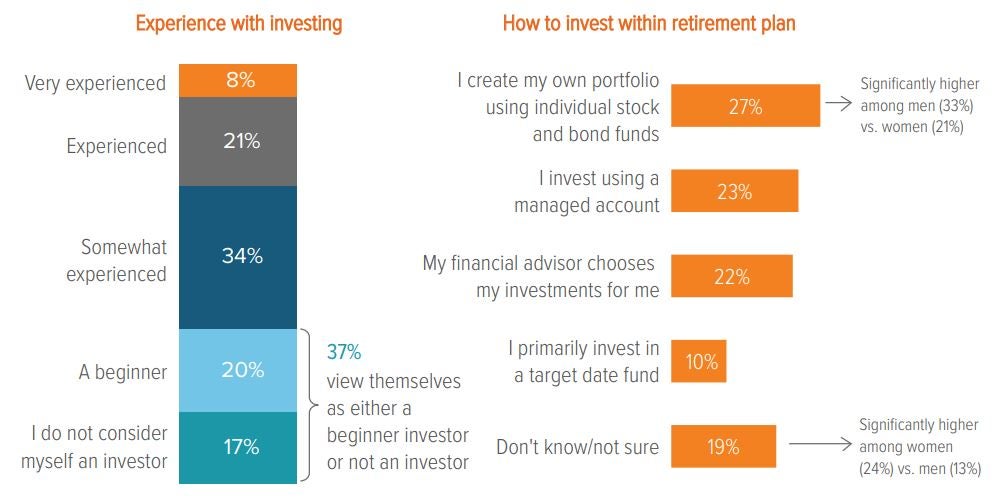

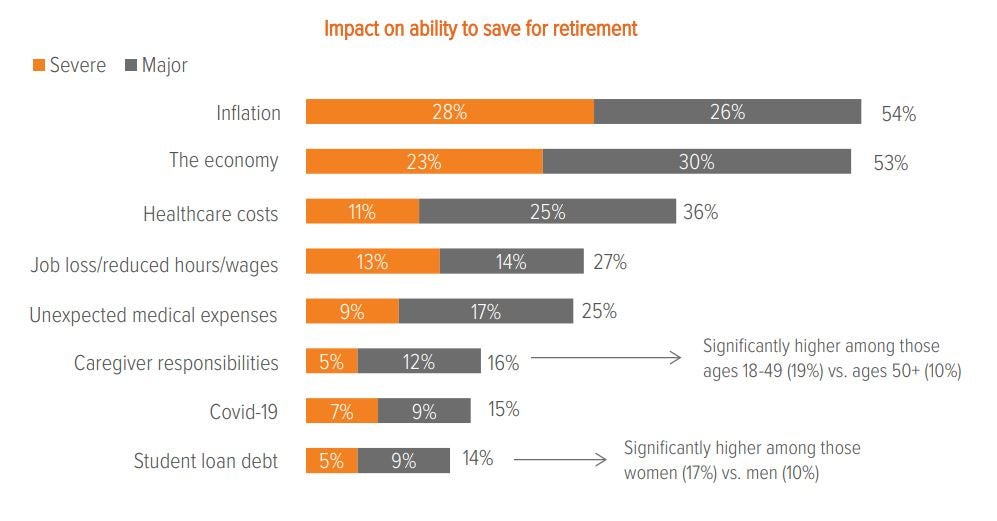

- 17% of participants cited caregiver responsibilities as having a severe or major impact on their ability to save for retirement, especially among participants between the ages of 18 and 49. 66% of participants said they are very or somewhat interested in comprehensive planning resources and support aimed at special needs caregivers, although sponsors underestimate this interest.

- More than 80% of participants said they are somewhat/very interested in getting help maximizing their benefit dollars across retirement savings, health savings accounts, healthcare insurance and voluntary benefits.

Introduction

Welcome to the first edition of Voya Investment Management’s survey of retirement plan participants. The survey seeks to better understand participant sentiments about financial and retirement planning priorities, the challenges and concerns participants face, and the services they may need—informing how plan sponsors and advisors can build more robust and competitive employee benefits programs. We’ve also included selected findings from other retirement surveys conducted during 2023 to provide additional insight into participant sentiment.

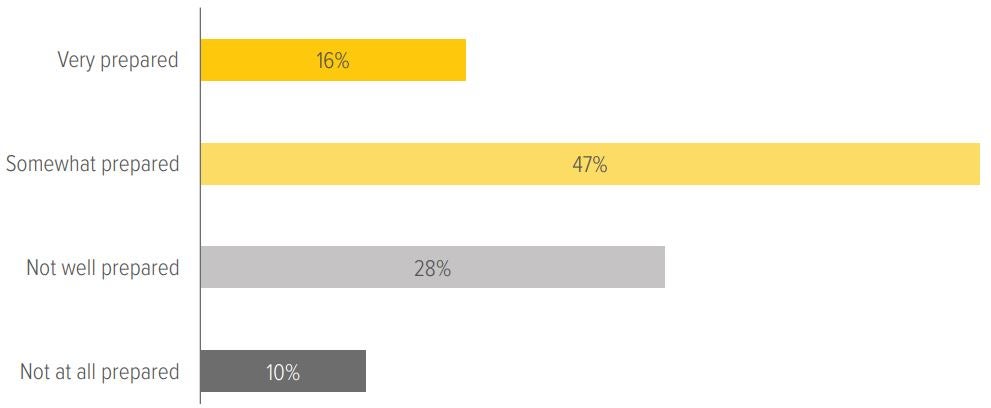

Though the majority of respondents felt at least somewhat prepared, 38% were concerned about their retirement readiness.

Economic backdrop

The survey, conducted March 3–4, 2023, should be viewed in context of a turbulent market environment and heightened investor anxieties. The economic recovery from the Covid pandemic that began during the second half of 2021 was challenged on multiple fronts in 2022—namely, by the crisis in Ukraine, rising inflation and sustained market volatility.

As respondents were completing the survey, 2023 was shaping up to be another challenging year. Further volatility was expected across multiple asset classes due to now-familiar headwinds, including the emerging consequences of higher interest rates, persistent inflation, higher-for-longer interest rates, and the possibility of recession in the not-too-distant future.

Retirement preparedness

Our survey indicates that a significant percentage of participants do not feel prepared for retirement. Inflation and the economy continued to be concerns, with more than half of participants believing these two factors will have a severe/major impact on their ability to save for retirement.

In a separate Voya Financial Consumer Insights & Research survey, conducted in June 2023, 75% of Americans with a retirement plan said they worry about the impact of inflation on their ability to save enough for retirement, and 41% of respondents with a retirement plan don’t think they will ever be able to save enough for retirement.1

Our participant survey revealed a meaningful gender gap in feelings of readiness, with women generally less likely to feel prepared than men. Working with a financial advisor boosted confidence among respondents: those working with an advisor were 17% more likely to indicate they were very or somewhat prepared for retirement.

Healthcare expenses also created anxiety for participants. About 33% said they were concerned about healthcare costs impacting their ability to save, and 25% said job loss, reduced hours/wages and unexpected medical expenses will have a severe or major impact on their ability to save for retirement.

Data from the Consumer Insights & Research survey supported these sentiments:

- 70% of Americans with a retirement plan said they worry about their ability to put aside money for an unexpected expense/emergency.

- 87% said they felt like their money doesn’t go as far as it used to go.

- 79% were concerned their workplace benefits will cost them more because of inflation.

- 80% expressed interest in receiving support to maximize their workplace benefits dollars across their retirement savings, health savings accounts, healthcare insurance and voluntary benefits at work.

Considering all these factors, participants are looking for support on how they can maximize their benefit dollars.

Investment experience and making retirement plan investment decisions

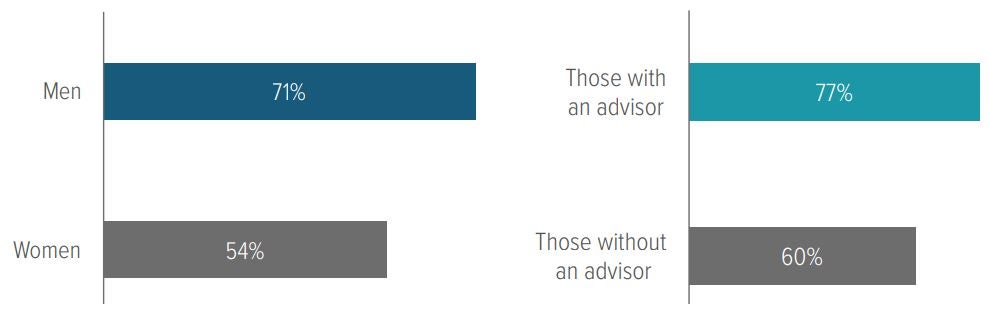

Nearly 30% of participants indicated they were very experienced or experienced investors (a higher sentiment among men and those working with a financial advisor). However, over one-third reported that they consider themselves either ‘not an investor’ (17%) or a ‘beginner’ investor (20%).

As far as how participants invest, the most common response was that they create their own portfolio (27%) using funds offered in the plan’s investment menu. This was followed by those who use a managed account or work with a financial advisor who chooses the investments for them (just over 20% for each), then those primarily using a target date fund (10%). A concerning observation is that one in five respondents didn’t know or were not sure how they invest within their retirement plan (a significantly higher sentiment among women).

Confidence in meeting retirement goals

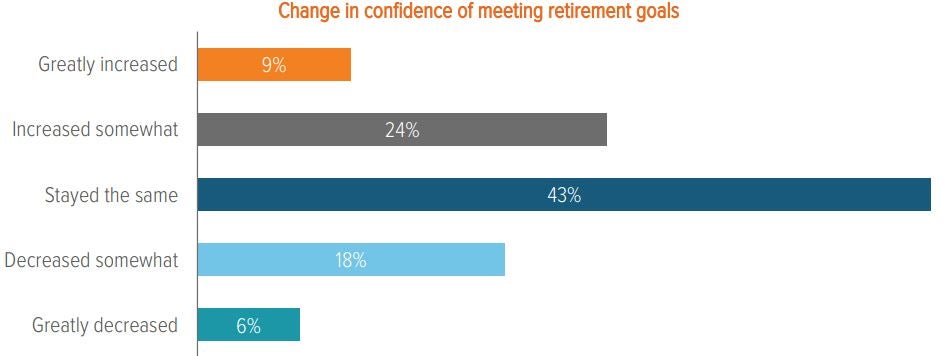

One encouraging trend—despite the challenging market backdrop—is that participants’ confidence in meeting retirement has generally increased over the past two years, with those indicating greater confidence (33%) outnumbering those who feel less so (25%). Those with increased confidence attributed it to doing research and learning more about their retirement plan or finances in general, as well as actively contributing to their retirement plan.

Decreased confidence typically related to concerns around inflation and rising gas prices/ cost of living. Many also mentioned they are worried about their ability to save enough to maintain their current standard of living in retirement.

Confidence in meeting retirement goals was closely tied to knowledge/education and the ability to save more. Those who said they are actively doing research to learn more or are prioritizing contributions felt more confident in their future:

- “My wife and I are saving more money these days.”

- “I’ve done a lot more research to understand things more to feel confident.”

- “I have become more knowledgeable and intentional about myself and family’s financial freedom.”

- “I think the more I learn about saving and retirement the easier it becomes to me.”

Decreased confidence in meeting retirement goals often related to inflation, rising gas prices/cost of living and an inability to save enough:

- “My confidence has changed because of the rising costs and the fact that there may not be enough money for when I retire.”

- “I feel with the current economy and fall of the stock market, my retirement age will need to be increased.”

- “My confidence has decreased in my ability to save enough for retirement due to inflation. The money I save won’t allow me to live comfortably when everything costs twice as much as it used to."

Confidence in making specific financial decisions

In making financial decisions, participants said they are fairly confident about how to pay off debt and budget for monthly living expenses. But confidence began to decline when considering how to estimate monthly expenses, how to prioritize where to save, and how much to set aside for unexpected emergencies. Understanding how to best plan for the future was also cited as a challenge for many participants (Social Security, child’s education, maintaining current lifestyle in retirement, maximizing HSAs, etc.).

Those ages 50+ were significantly more likely to say their confidence in meeting retirement goals has decreased greatly or somewhat (31%) than those ages 18–49 (21%).

Confidence in making retirement plan-related decisions

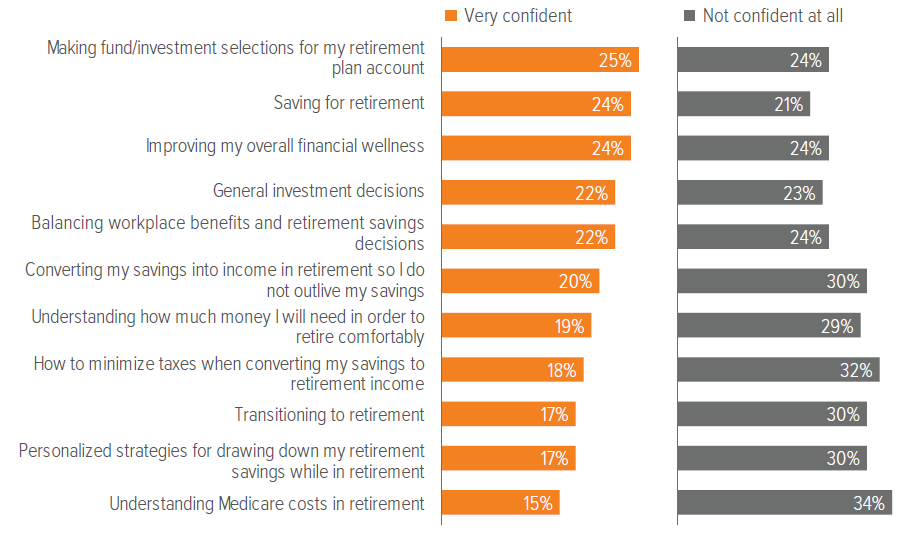

Confidence related to specific retirement plan-related decisions was relatively low with just 25% of participants reporting they are very confident making fund/investment selections, saving for retirement and improving their overall financial wellness. An almost equal number of participants also said they are not at all confident in making these decisions, signaling room for support/education.

Confidence continued to decline when it comes to making general investment decisions, balancing benefits and savings decisions, and transitioning to retirement (converting savings to income, draw-down strategies, minimizing taxes, Medicare costs, etc.).

Plans for retirement age and plan assets at retirement

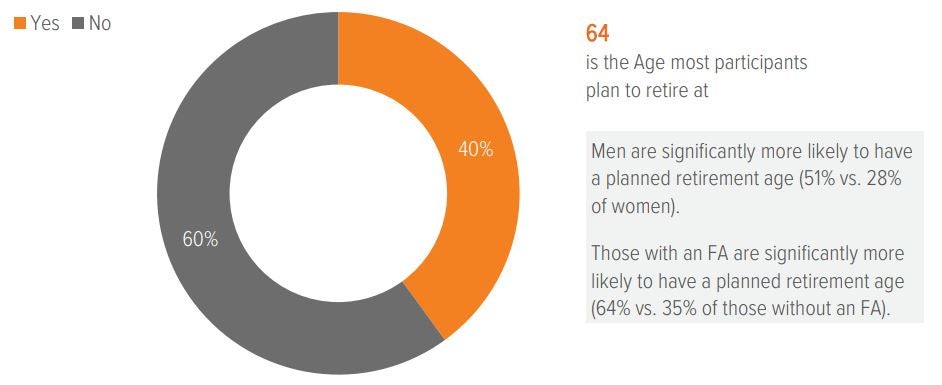

Two out of five of participants said they have a planned age for retirement, with 64 being the age most respondents plan to retire. Men and those working with a financial advisor were significantly more likely to have a planned retirement age than women and those without a financial advisor.

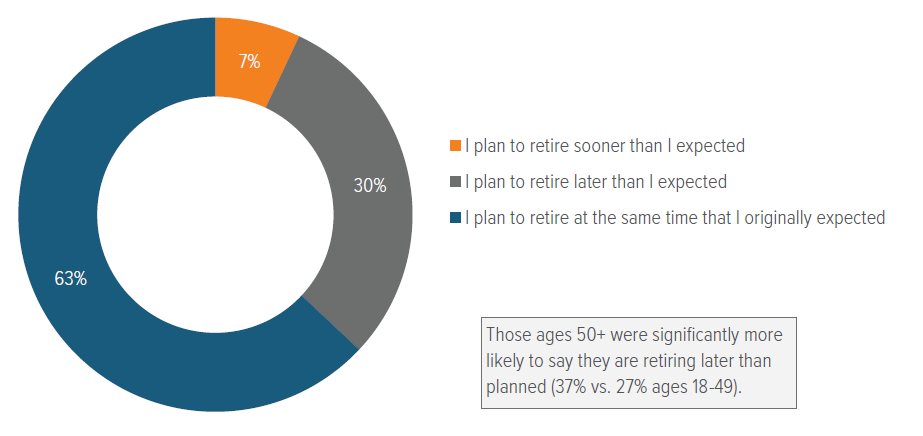

The long-term effects of Covid, market volatility and inflation have caused many participants to push out their retirement date, with 30% now planning a later retirement. Those age 50 and older (who are closer to retiring) are feeling this impact more strongly and were significantly more likely to say they are retiring later than planned.

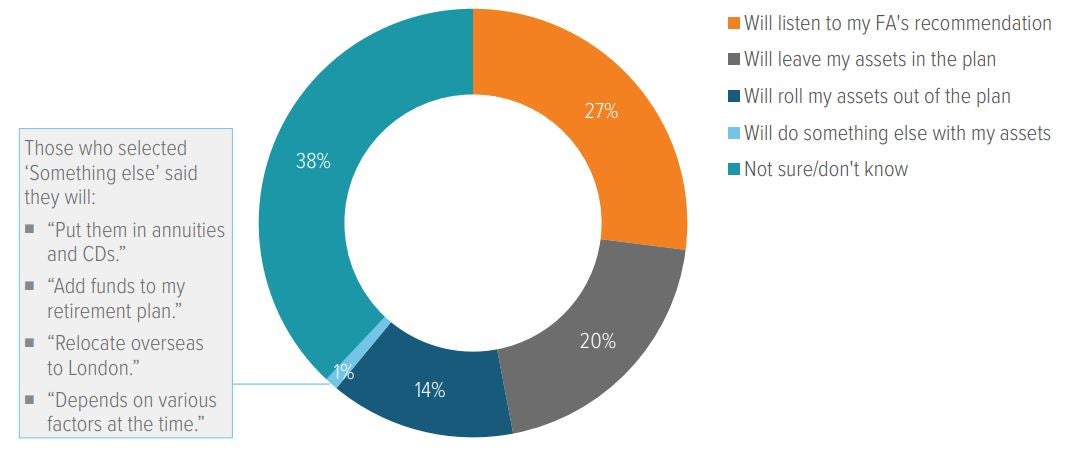

Nearly 40% said they are not sure or don’t know what they will do with their retirement assets when they retire, a significantly higher sentiment among women. Just over 25% of participants said they will listen to advisor recommendations on what to do with their retirement assets once they retire. Another 20% said they intend to leave their assets in the plan (a more common response among those ages 50+ at 26%). Women were significantly more likely to say they don’t know/are not sure what they will do with their retirement assets when they retire (47% vs. 28% of men).

Interest in employer-sponsored retirement plan features

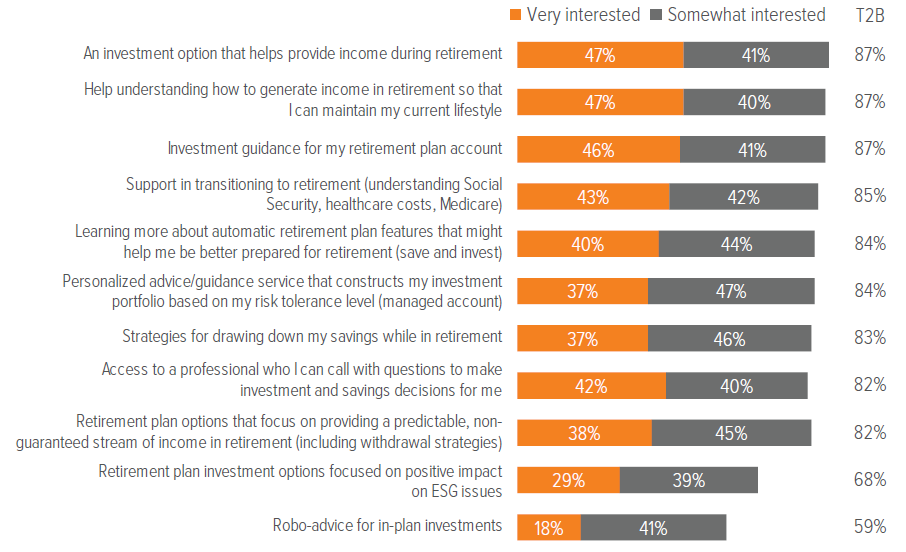

When it comes to employer-sponsored retirement plan (ESRP) features, most participants expressed interest in getting help related to retirement income and advice/guidance for investment decisions. There was strong interest in an investment option that helps provide income during retirement, help in understanding how to generate income in retirement, investment guidance for their retirement plan and support in transitioning to retirement.

Most participants were also interested in learning more about automatic plan features and managed accounts and having access to a professional for advice.

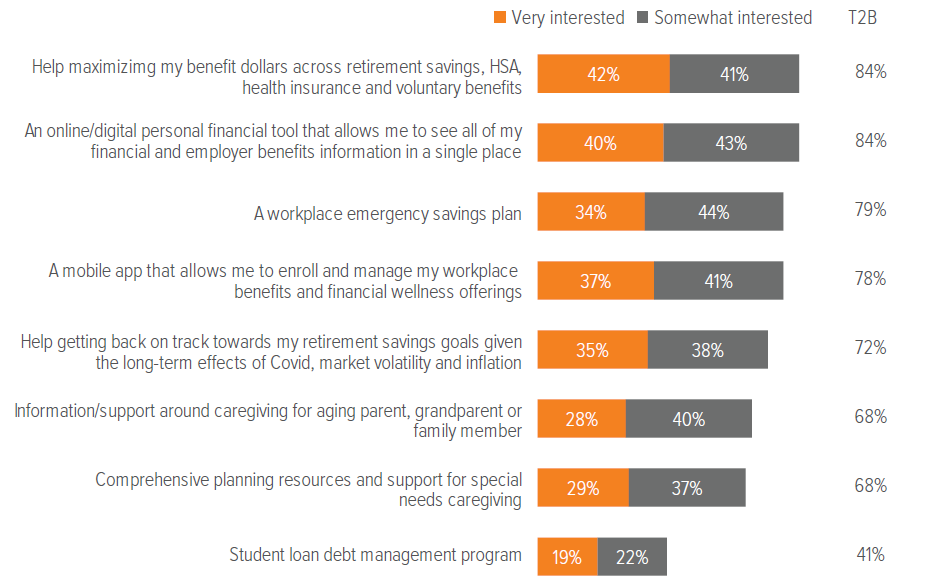

More than 80% of participants said they are very/somewhat interested in help maximizing benefit dollars and an online/digital financial tool that allows them to see all their financial and employer benefits in one place.

About 75% said they are also interested in a workplace emergency savings plan, a mobile app that would allow them to manage their workplace benefits and financial wellness offerings, and help getting back on track towards retirement savings given the long-term effects of Covid along with market volatility and inflation. There was also substantial interest in support services for caregivers, although lower than the other services noted above.

Financial wellness program features

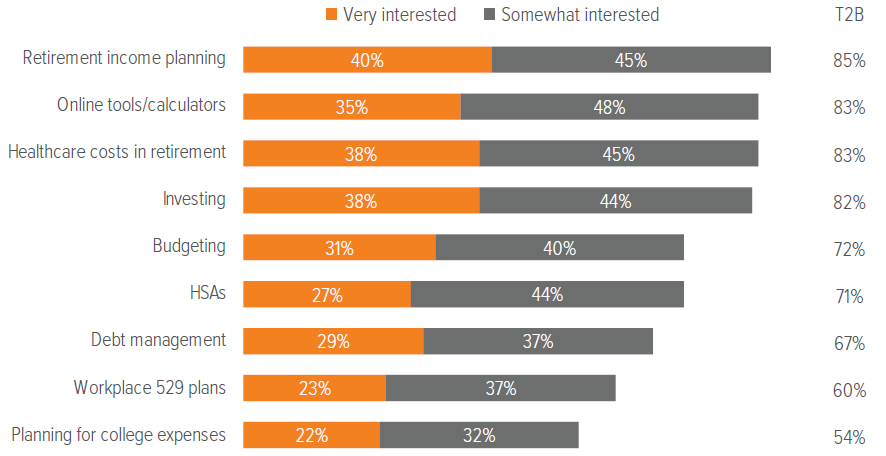

Participants demonstrated a high level of interest across several key financial wellness program features, notably education on retirement income planning, online tools and calculators, education on the cost of healthcare in retirement and in investing. Seven out of ten respondents said they would like to receive education on budgeting, HSAs and debt management. About 60% expressed interest in education around 529 plans and planning for college expenses.

Role of employers/ESRP and impact on employee retention

Four out of five participants said they trust the retirement planning services offered to them by their employer and are confident that their employer’s retirement plan will help them achieve their retirement goals.

For most employers, employee retention matters, as hiring and training new workers comes with a substantial time commitment and cost. Employers who wish to reduce employee turnover should consider the survey findings below.

Conclusion

Our first-ever participant sentiment survey covered a lot of ground. Broadly, it focuses on two components: retirement income and financial wellness (which includes considerations for caregivers).

Retirement income

Retirement readiness is a major challenge for many participants. The SECURE 2.0 legislation, recently passed by Congress, helps sponsors provide their participants with the tools and resources they need to meet this challenge. This legislation, along with its predecessor SECURE Act, provides sponsors more flexibility when it comes to offering retirement income products and services, as well as expanding access to them for participants.

For sponsors, plan design is no longer about simply focusing only on helping participants build their savings. Assisting participants with income planning as they enter the decumulation stage is now equally important, especially because many lack confidence in this area. As workers approach retirement, their investment priorities also shift. They become less concerned with growth and more concerned with preservation of capital and generating income.

Many plans tend to fall short when it comes to providing income-generating options to retirees and pre-retirees. In our view, there is no one-size-fits-all solution to helping participants feel retirement ready. Instead, sponsors may want to consider updating plan design, offering new investment options, and building a more robust financial wellness program.

Financial wellness

Financial wellness is a lifelong journey that begins with a single step. A thoughtfully designed financial wellness platform can make it easy for participants to not only see the big picture, but to also act upon it. We believe that sponsors should consider six distinct areas when building a financial wellness program for their employees:

- Protection (insurance, estate planning)

- Spending and saving (building a realistic budget)

- Emergency fund (3-6 months’ financial cushion)

- Retirement (employer-sponsored plans, HSAs)

- Debt management (paying off debt, avoiding “bad” debt)

- Saving for other goals (college savings, saving for a home)

Survey methodology

Voya Consumer Insights & Research assisted Voya IM with the development, execution and analysis of the retirement plan participant survey. Data are based on the results of a Voya Financial Consumer Insights & Research survey conducted between March 3–4, 2023 among n=500 Americans age 18+ who are full-time employees and actively contributing to their employer-sponsored retirement plan balanced by age and gender to reflect the U.S. population.

Additional screening criteria included:

- U.S. residents, ages 18+ (n=337 ages 18–49, n=163 ages 50+)

- Mix of employer sizes (companies with fewer than 25 employees excluded)

- Nat. rep. sample: Balanced by age and gender, while controlling for pre-retiree sample