Cash has a place in portfolios, but bonds are a better choice for locking in yields, boosting return potential and providing diversification benefits.

Cash has done a great job in recent years helping investors protect their portfolios from market turbulence. That was especially true in 2022, when both stocks and bonds plunged as the Federal Reserve ratcheted interest rates higher to tame the worst inflation in decades. No wonder investors have poured billions into high-yielding money market funds and other cash-like vehicles.

But keeping your eyes on the rearview mirror rather than on the road ahead won’t get where you want to go. If you still have a pile of cash on the sidelines, there are strong reasons to consider putting some of it back to work in bonds.

Bond yields are in a far better position now

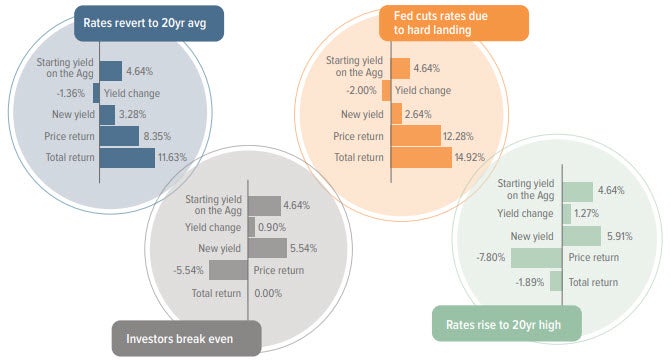

When interest rates rise, bond prices fall. So when rates went from near-zero to 5%, bonds took a hit. Higher rates can soften the blow of further rate increases on bond performance—not to mention provide attractive upside if rates should fall. Exhibit 1 shows how four potential interest-rate scenarios may impact bond returns.

As of 07/31/24. Source: Bloomberg Index Services Ltd., Voya IM. For illustrative purposes only. Calculations are based on the Bloomberg U.S. Aggregate Bond Index current duration of 6.14 years and assume immediate parallel shift in yield curve (with the new yield then earned for the 12-month period). Bonds pose a higher risk than Treasury bills, which are guaranteed as to the timely payment of principal and interest. Investors cannot invest directly in an index. See back page for index definition and additional disclosures.

With this strong starting position in mind, let’s explore the three potential benefits of getting back into bonds.

1. Lock in current high yields

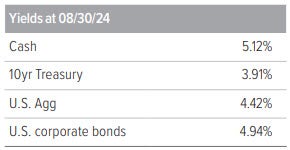

Longer-term bonds typically offer higher yields than short-term bonds. But high inflation and a slowing economy have turned the tables, and short-term cash equivalents currently yield more than 10-year Treasury bonds. The bad news is that if interest rates fall, those hefty cash yields could dissipate. The good news is that bonds allow you to lock in current yields for the long run. The better news is that many bond mutual funds invest across the broader bond market and are benchmarked to the Bloomberg U.S. Aggregate Bond Index, which now offers yields comparable to current cash rates.

Source Bloomberg Index Services Ltd., Voya IM. Bonds pose a higher risk than Treasury bills, which are guaranteed as to the timely payment of principal and interest. See back page for index definitions. Past performance does not guarantee future results.

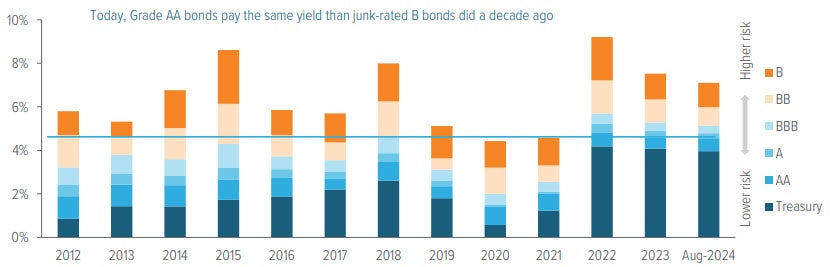

In fact, today’s bonds offer more yield for less risk. The back-up in yields since 2021 has allowed investors to earn significantly higher yields relative to the credit risk of a bond issuer. As a result, investors no longer need to rely on low-quality, high-risk bonds to earn attractive yields.

As of 08/30/24. Source: Bloomberg Index Services Ltd., Voya IM. Treasury: Bloomberg U.S. Treasury Index. Yields by credit quality: Bloomberg U.S. Corporate Aa, A and Baa subindices and the Bloomberg U.S. High Yield Corporate 2% Issuer Cap Ba and B subindices. Bonds pose a higher risk than Treasury bills, which are guaranteed as to the timely payment of principal and interest. Credit ratings are an assessment of the risk of default of a company or country. The higher the credit quality (or rating), the lower the perceived risk of default. AAA rated are the highest; D rated are the lowest. Ratings below BBB are classified as non-investment grade, or junk, and are considered to be riskier. Past performance does not guarantee future results.

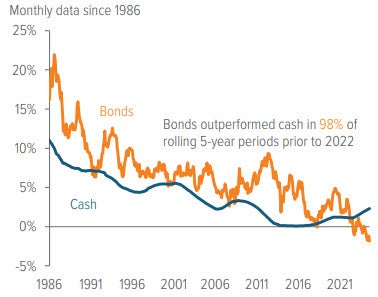

2. Capture better returns over time

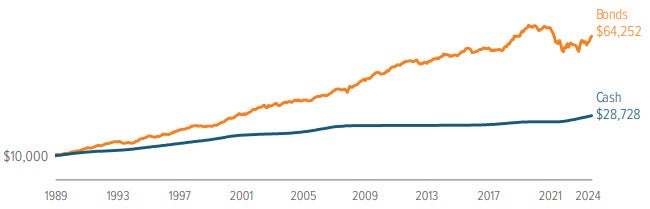

Over the past 40 years, bonds have averaged a 6.4% annual return—about 1.5 times the 4.1% return of cash.1 Bonds have also been consistent outperformers: In the 433 months from January 1986 to April 2022, bonds had a better 5-year return in all but 10 periods—a 98% success rate (Exhibit 4). In those few instances where cash did better, it only outperformed by 0.38% on average, and its lead soon vanished. Bonds have simply done a better job than cash at helping investors grow their assets over the long term.

Source: Bloomberg Index Services Ltd., Voya IM. Annualized returns from 01/01/81 to 08/30/24. See back page for index definitions. Past performance does not guarantee future results.

As of 08/30/24. Source: Bloomberg Index Services Ltd., Federal Reserve, Voya IM. See back page for index definitions. Past performance does not guarantee future results.

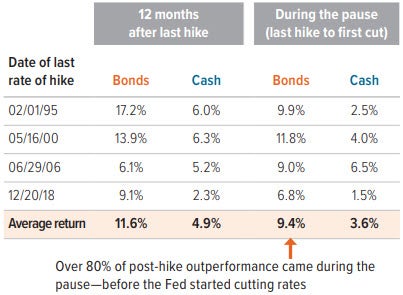

And yet, a common refrain we hear from investors is: “I’ll wait for the Fed to start cutting rates before moving out of cash.” But what does history show? Over the past four interest-rate cycles, bonds outperformed cash by about 6% on average in the 12 months following the Fed’s last rate hike (Exhibit 5). However, in each case, the yield on the 10-year Treasury peaked before the Fed started cutting rates. Those periods between the peak in yields and the first-rate cut were great for bonds, which averaged a 9.4% return—capturing more than 80% of the one-year return after the last rate hike. In other words, investors who waited for the Fed to cut left money on the table.

3. Prep your portfolio for possible turbulence

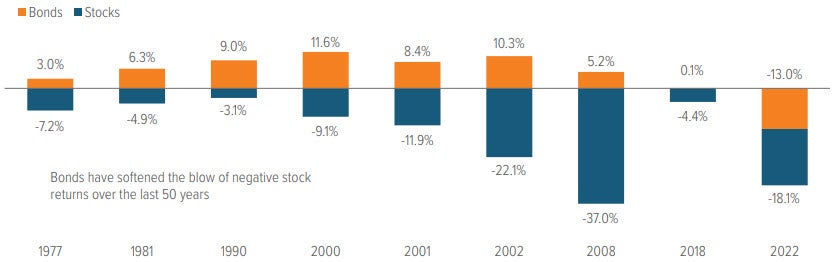

Bonds have played an important part in providing stability during turbulent times in the stock market, reducing overall losses in portfolios. In eight out of the nine years of negative S&P 500 Index returns over the last 50 years, bonds helped offset stock declines. (2022 was the exception, as the sharp rise in rates hurt both stocks and bonds). Now that bond yields have reset at significantly higher levels, we believe bonds have regained their role as portfolio diversifiers.

As of 08/30/24. Source: Bloomberg Index Services Ltd., Federal Reserve, Voya IM. See back page for index definitions. Past performance does not guarantee future results.

Cash and bonds both have roles to play

The question to ponder isn’t whether to invest in cash OR bonds, but what the most appropriate balance between the two is, based on your long-term investment goals. Cash is currently earning high interest and provides a safe place to stash savings to cover short-term expenses and emergencies. Bonds now offer higher yields for less risk than at any other point in over 15 years and can support your portfolio in times of stock market volatility.

As of 08/30/24. Source: FactSet, Voya IM. See below for index definitions. Past performance does not guarantee future results.

A note about risk

The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition.