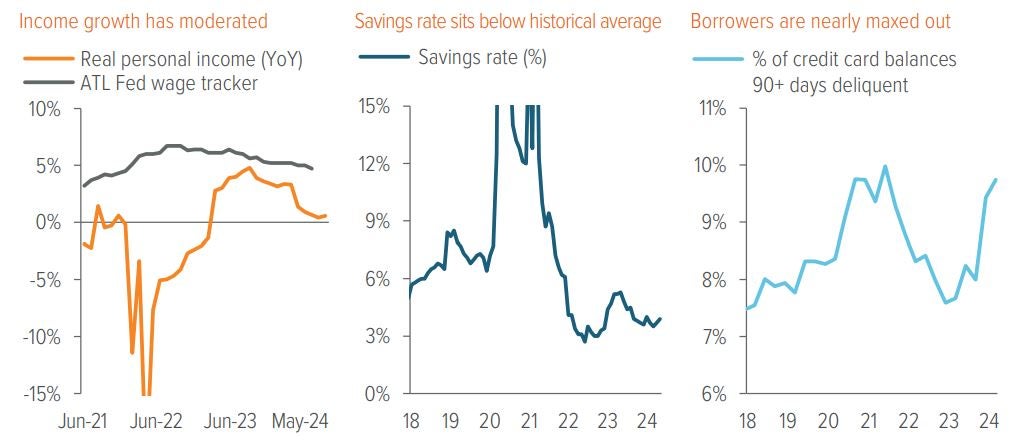

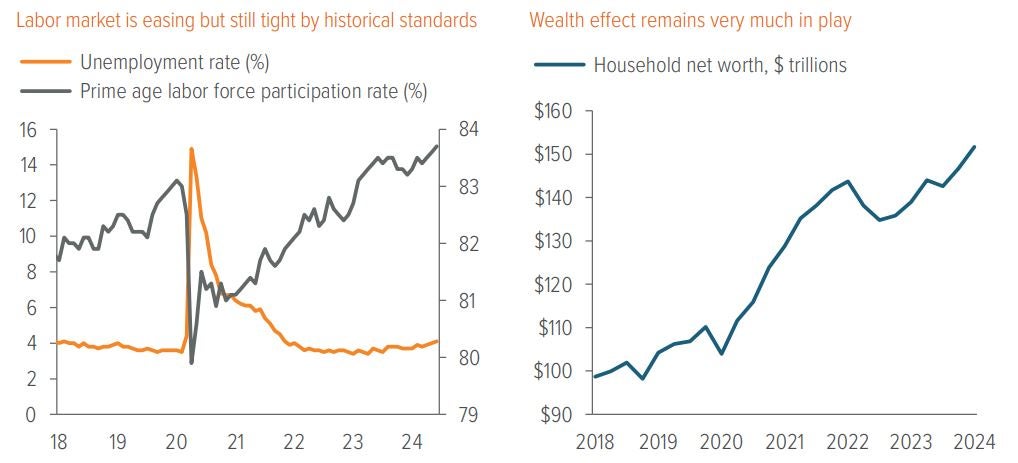

The wealth effect will continue to support consumer spending, even as slowing wage gains and high prices weigh on low-income consumers.

As of 05/31/24. Source: U.S. Bureau of Labor Statistics, Federal Reserve Bank of Atlanta, Bureau of Economic Analysis, New York Fed Consumer Credit Panel, Equifax.

Source: Left panel: U.S. Bureau of Labor Statistics as of 06/30/24. Right panel: Federal Reserve Bank of St. Louis as of 01/01/24.

Yes, consumption growth is set to slow... We’ve noticed some concern among clients about signs of a slowdown in consumer-led economic growth. Income growth has stalled, the savings rate is below its historical average, and consumer balance sheets appear strained as shown by the recent uptick in credit card borrowers with delinquent payments.

...But unemployment remains low and consumers are wealthier in aggregate. The labor market paints a more optimistic picture of overall consumer health. Employment data continues to be strong by historical standards. In addition, consumers are feeling the positive effect of increased wealth, as a rising stock market and home price appreciation has increased aggregate household net worth consumption was reinforced by June’s stronger than expected retail sales report.

This backdrop of resilient (but slowing) economic growth combined with cooling inflation gives the Fed more space to cut rates. As we stressed last month in our themes for the second half of 2024, investors should prepare for volatility. This is especially true as we head into an unpredictable election season. The good news is that periods of volatility may provide opportunities to opportunistically add risk.

As of 06/30/24. Sources: Bloomberg, JP Morgan, Voya IM. See disclosures for more information about indices. Past performance is no guarantee of future results.

Sector outlooks

Investment grade corporates

- While the sector experienced pressure from short-term technical trends, the broader macro backdrop remains supportive of investment grade (IG) corporate fundamentals.

- New issuance was above average in June but continued to trend down from the higher levels earlier in 2024. In addition, fund flows into IG credit were slow, which caused some stress on the technical side.

- As second-quarter earnings kick off, tech and energy companies are expected to lead the way.

- Positioning: We remain overweight financials, BBBs and the 10-year part of the curve.

High yield corporates

- Technical dynamics continue to support the sector, as investors are drawn to high all-in yields.

- We expect 2Q24 earnings to remain supportive of high yield despite the increasing risk that the abatement of pricing power may begin to pressure corporate margins in coming quarters.

- Higher interest costs have begun to weigh on credit quality at the low end, but defaults and credit stress remain limited.

- Positioning: We are overweight food/beverage, builders/building products, healthcare/pharma and energy. We are underweight technology, as well as media/telecom companies with structurally challenged business models.

Senior loans

- Despite the strong rally so far this year, the loan market posted weaker returns in June, as demand for the asset class moderated during the month.

- While defaults are likely to increase modestly (from their low levels), we don’t foresee a material pick-up in the near term given the relatively strong economic backdrop.

- Corporate earnings are solid, but there continues to be dispersion among issuers and sectors.

- Positioning: We maintain cautious sectoral views and up-in-quality positioning. We are cautious on cyclical sectors and those reliant on discretionary consumer spending.

Agency mortgages

- Overall, we expect fundamentals and technicals to support mortgage returns for the remainder of 2024.

- However, in the short term, the performance of agency mortgages will be closely correlated with overall volatility and rate directionality in the near term.

- Mortgages have recently outperformed, but spreads remain within the fair range for most cohorts.

Securitized credit

- Demand for securitized assets is strong across investor types in virtually all securitized sectors.

- Late cycle housing market is vulnerable to distorted supply/demand dynamics. Regardless, resi-mortgage credit behavior remains insulated by “golden handcuffs” of <4% mortgages, solid labor markets and historically high homeowners’ equity. Rock-bottom prepayment speeds remain priced and limited new issuance keep market technicals favorable. Hold scarce non-agency RMBS risk, even if housing markets falter; add if weakness follows.

- Improved financial conditions have helped restore fair value in CMBS and reduced “easy money” opportunities. As remaining problem loans resolve, collateral based security selection will replace asset allocating to the sector to best harvest further outperformance. Property type remains the key dimension when navigating the opportunity set.

- ABS issuers are monetizing fully-scaled investor affinity via a historically high pace of new issuance. The “harmony” between issuers and investors has created a bonified ‘virtuous cycle’ of reliable primary market execution inspiring more issuance which attracts more capital, reinforcing stable risk/return opportunities. Strong Sharpe and/or Information Ratios on offer.

- After very strong performance year to date, CLOs are poised for a pullback as the backdrop for the sector continue to weaken. While ‘hard landing’ risk remains low, a more attractive environment for duration will emerge as a key source of investor attrition for this floating rate sector. Elevated issuance–both new and refi/reset–will couple with slower economic growth to also reduce sponsorship. Healthy structural protections will help insulate IG tranches from a deep credit cycle, but expect more volatility in this “late-cycle” sector.

Emerging market debt

- The macro environment remains generally benign for the asset class and emerging market (EM) spreads have been resilient.

- While China’s latest policy response appears to have stabilized the country’s economic activity, housing and private sector confidence remain weak and growth is likely to slow.

- Positioning: Absolute yield levels remain attractive relative to historical levels, and we continue to find the most attractive opportunities in LatAm corporates.

A note about risk The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. |