Investment management, much like the NBA, has undergone a significant evolution. Just as basketball has shifted towards a more analytics-driven game, some investors are embracing new strategies to achieve better results.

The NBA’s 3-point revolution increased scoring effectiveness

Twenty years ago, NBA offenses focused on shooting within the arc—taking mid-range jump shots outside of the paint or layups close to the rim. Duos such as Lebron James and Dwayne Wade from the Miami Heat, and Steve Nash and Dirk Nowitzki from the Dallas Mavericks, perfected 2-point field goals to become some of the best offensive players of their time.

But within the last five years, the league has realized that a 3-point shot has a higher expected value than a mid-range 2-point shot. This realization revolutionized the game and benefitted players such as Steph Curry and James Harden.

To put the evolution in perspective, Nash and Nowitzki scored over 109 points per 100 possessions, the most efficient offense in basketball 20 years ago. Last season, that performance would have ranked second worst in the league!

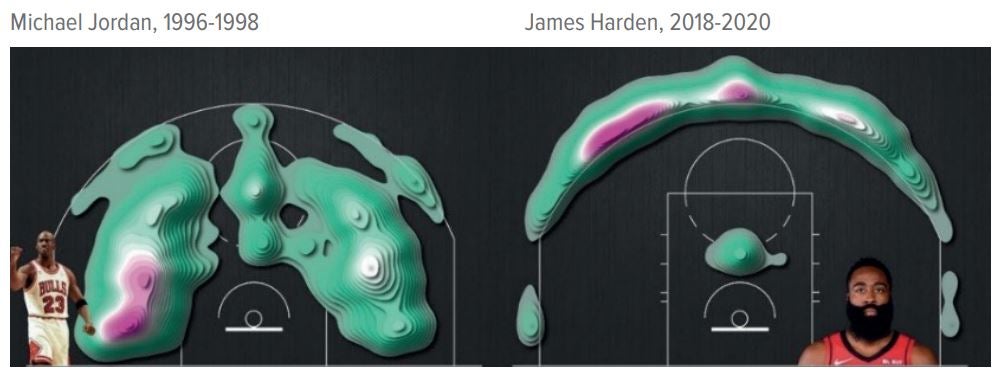

Consider another comparison of the GOAT Michael Jordan and James Harden (see graphic). Jordan rarely shot beyond the arc. Most of his tries were mid-range 2-pointers. In contrast, Harden almost always shot threes from “downtown.”

No one is arguing that Harden is a more skilled player than Jordan, but the evolution of the game—using better information from modern analytics—put him in a better position to score more efficiently.

Source: @kirkgoldsberry. The colors show the location of the shooter. As the colors go from light green to pink, the shot frequency by location increases, with pink being the more frequent.

Value investing is no longer just low multiples or high yields

Just as basketball has morphed over the years, so has value investing. Today, many value managers still focus on the inefficient mid-range jump shot, using traditional approaches such as low price-to-earnings, low price-to-book, dividend yield and free cash flow yield. Instead, we employ excess capital yield (ECY).

ECY provides a more holistic view of the amount of capital a company has available to create value, not just in the form of dividends but also in terms of mergers and acquisitions (M&A), share buybacks and internal investments. This modern strategy has generated superior historical returns with lower volatility, resulting in the strongest risk-adjusted returns compared to other value metrics.1

Discover how Voya Large Cap Value drives success with excess capital yield. |