Strong economic growth coupled with inflation risks from potential policy shifts have paved the way for a prolonged period of higher interest rates. That could be a good thing for fixed income investors.

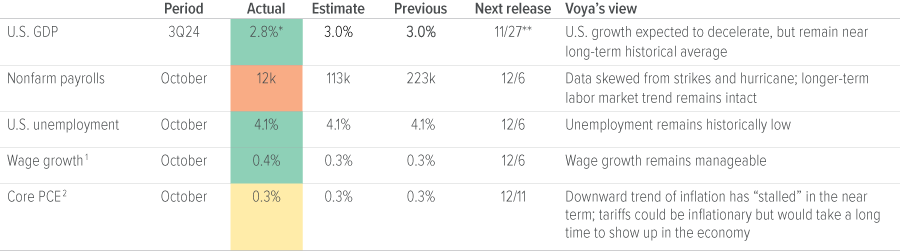

As of 11/15/24. Source: Bloomberg, Factset, Voya IM.

* Advanced estimate.

** Second estimate.

No patience for patience

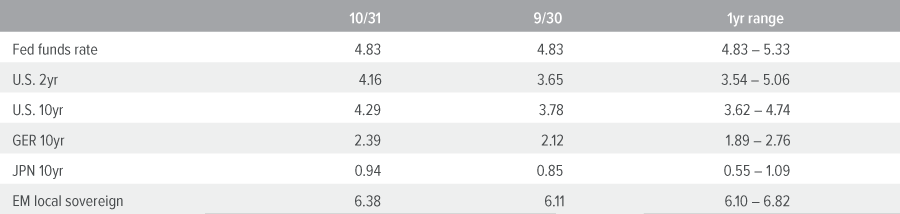

Last month, we noted that markets could be caught offsides with expectations for a fast cutting cycle. Those expectations have now been unwound. On November 14th, Federal Reserve Chair Powell acknowledged the strength of the U.S. economy, stating, “The economy is not sending any signals that we need to be in a hurry to lower rates.” Markets reacted swiftly, with short-end Treasury yields rising as December rate cut expectations fell from near certainty to a coin flip. This higher-for-longer outlook, together with Donald Trump’s victory, added pressure on yields.

Preparing for volatility

The U.S. election outcome signals a move towards policies that prioritize domestic industries and a renegotiation of trade agreements, as discussed in our analysis, “5 Investor Takeaways: Red Wave Paves the Way for Economic Protectionism.”

But as much we have a sense of Trump’s policy ambitions, uncertainty around eventual specifics underscores the likely volatility awaiting investors in the months ahead. While markets may react quickly to policy announcements, the economic effects will take time to materialize, creating opportunities (and risks) for investors. For example, new tariffs and tax cuts could happen relatively quickly and might influence investor sentiment before they influence the economy. Other issues such as immigration reform could take longer to play out, especially in the context of labor supply. One thing the market agrees on, however, is that inflation risk has moved higher.

In the short term, the good news is that the economy— particularly the U.S. consumer base—remains on strong footing. And while a “higher for longer” scenario might mute potential price gains for bonds, it isn’t necessarily a bad thing, as it enables fixed income investors to lock in higher yields.

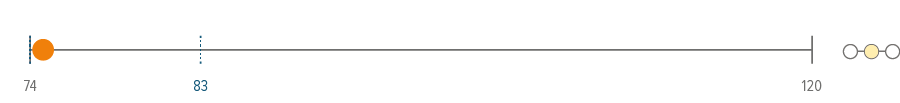

For an overview of how we are positioning our multi-sector portfolios in this environment, please see relative value rankings in the sector outlooks below.

As of 10/31/24. Sources: Bloomberg, JP Morgan, Voya IM. See disclosures for index information. Past performance is no guarantee of future results.

Sector outlooks

- With 3Q24 earnings season nearly complete, companies, in aggregate, are beating earnings expectations.

- While October new issuance was higher than anticipated, dealers balance sheets are light to start November, which is generally positive for spreads.

- Among industries, energy, insurance, airlines, railroads and tobacco companies appear to be winners from the presidential election outcome.

- While the market continues to be supported by high all-in yields, we are keeping some dry powder on hand as slowing top line growth and margin compression may provide opportunities to add risk at wider levels.

- We expect credit stress and defaults to remain limited.

- From a positioning standpoint, we are overweight food/beverage and healthcare/pharma, and underweight technology, as well as media/ telecom companies with structurally challenged business models.

- Performance in the loan market was solid for the month, adding to the sector’s strong year-to-date returns.

- Easing Fed policy should lower financing costs for loan borrowers and provide a buffer in the event of a more pronounced slowdown in economic activity.

- Strong technicals and stable fundamentals continue to support spreads, while high starting yields provide a cushion against spread widening.

- Credit selection remains key in this environment and we’re paying close attention to segments in consumer services for further evidence of continued deceleration given the lower guidance in industries such as airlines, hotels, autos, and manufacturers.

- We remain cautious of cyclical sectors and those areas of the loan market that are reliant on discretionary consumer spending. In our underwriting process, we are paying very close attention to a company’s forward-looking growth and profitability prospects, downgrade risk, liability management prospects, loan-to-value, liquidity and free cash flow flexibility.

- Overall, we expect fundamentals and technicals to support mortgage returns for the remainder of 2024.

- Despite the Fed’s recent interest rate cuts, lower coupon TBA financing rates have not adjusted accordingly, making this part of the coupon stack less attractive.

- The correlation of agency mortgages’ performance with overall volatility and rate directionality should continue to weaken, as the sector’s high relative yields have attracted investor demand—going forward we expect fund flows to be a larger driver of returns.

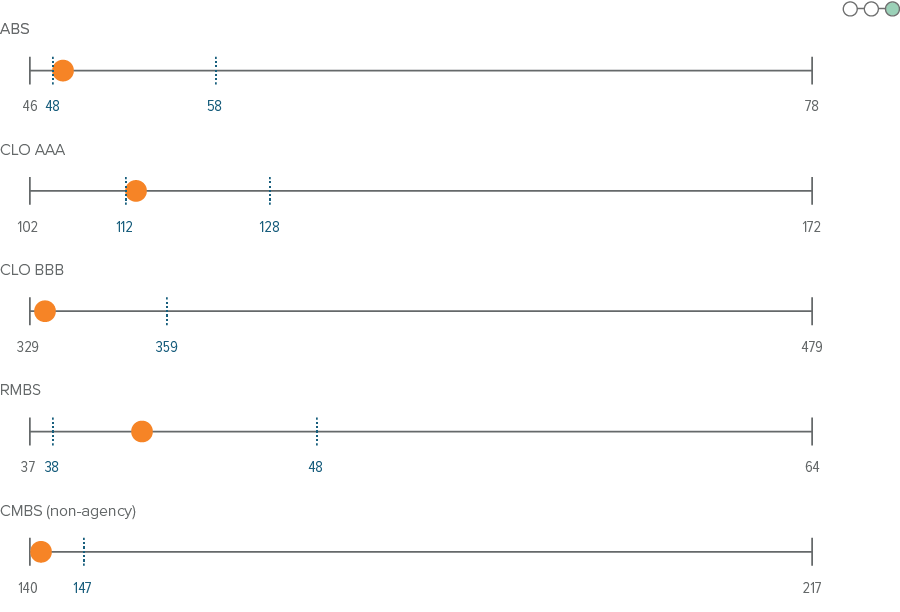

- Amid a landscape of robust securitized issuance and, on balance, supportive macroeconomic environment, the securitized credit market is demonstrating resilience, buoyed by the relative strength of U.S. consumers and initial repair in commercial real estate.

- The ABS market stands to benefit from improving technical conditions, which should help ensure the sector’s status as a safe-haven allocation amidst bouts of market volatility. Sub-sectors backed by low-income consumer cohorts remain vulnerable, particularly as labor markets moderate; defensive positioning here is warranted, even with the improved rate backdrop.

- After a long streak of outperformance, CLOs are more vulnerable to falling rates and slower economic growth, with the sector facing potential headwinds from the Fed reducing rates and the feed through into lower CLO base rates (3-month SOFR).

- Improved financial conditions have helped reduce the crisis like spread premiums once available in CMBS, effectively reducing “easy money” opportunities. As remaining problem loans continue to resolve, collateral-based security selecting will slowly but surely replace simply asset allocating to the sector and “buying the sector.” In addition, the space should benefit from lower rates, especially for instruments with shorter repayment profiles that continue to trade at steep discounts.

- Residential-mortgage credit behavior is set up to remain insulated from a modest decline in home prices. Average mortgage rates for existing homeowners are <4% and the buffer of homeowners’ equity remains at or near historical highs.

- While the macro backdrop remains favorable for emerging market debt given rate cuts by the Fed and increased stimulus from China, the asset class could be hurt by new trade policies from the United States under the new administration.

- Rollover risk has diminished given a robust new issue market that has restored access to frontier sovereigns and high yield corporates.

- Corporate fundamentals overall remain resilient and financial policy remains prudent. Corporate default rates are expected to be lower due to fewer defaults in Asia and Europe.

A note about risk

The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition.