Capital markets have responded positively to better-than-expected economic outcomes so far this year. While the United States has managed to avoid an official recession, growth is almost certain to slow and increases in profits will be challenged. Given this backdrop, we see equities trading sideways to slightly higher in the near term and we continue to favor the U.S. over the rest of the world.

Tactical indicators

Economic growth (slowing) Demand is holding up as inflation quickly cools, but we think increasingly tight monetary conditions will slow output notably toward the end of this year and into next. Weaker but still historically strong levels of employment should help prevent a major economic downturn.

Fundamentals (neutral) Slowing nominal GDP will challenge revenue growth and profit margins. Consensus expectations look optimistic as margins typically contract in a decelerating pricing environment. Nonetheless, strong earnings guidance from company management and improved macro data could help equities grind higher in the near term.

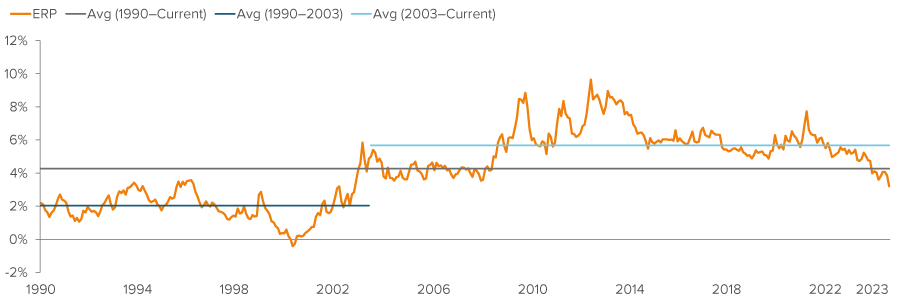

Valuations (negative) U.S. stocks appear reasonably priced, but the equity risk premium has tightened and higher bond yields make fixed income marginally more attractive from a valuation standpoint.

Sentiment (neutral) Market-based sentiment indicators have shifted from bearish to modestly bullish. Consumer sentiment has surged recently, providing evidence of the potential for continued durability in consumer spending.

Quick take

- At the outset of this year, calls for imminent recession proliferated and investor positioning was extremely bearish. Yet economic and corporate earnings data were generally better than expected and many of the most feared geopolitical tail risks seem to have lessened (at least temporarily). As a result, risk assets posted another quarter of strong returns, driven by the largest and growthiest names in the U.S. While this trajectory for equity prices is unlikely to persist, we think leadership can broaden to other sectors and don’t foresee significant near-term declines.

- Slowing economic growth will weigh not only on prices, but also on profits. Consumer spending is already moderating. If the labor market stays tight, however, the economy should be able to avoid a significant dent in demand.

- Following the Federal Reserve’s latest rate hike that brought the fed funds rate target range to 5.25–5.50% and a report that inflation is cooling, the bond market thinks further rate hikes are now off the table.

- Amid disinflationary forces and an improving macro environment, U.S. large caps could continue to grind higher as corporate and investor sentiment perks up.

- We continue to favor domestic assets and maintain underweights to international equities. However, our outlook on foreign developed market stocks is primarily driven by our less sanguine view of Europe. Japan looks attractive now.

- Following the reopening of its economy, China’s performance has been disappointing. Without the expected economic momentum, structural headwinds have resurfaced; our underweight to China and to emerging markets remains.

- Our preference for high-quality fixed income persists given high base rates, reasonable spreads and tightening credit conditions.

Portfolio positioning

Fundamentals appear mixed, but lower bond yields and the disinflationary impulse from monetary policy-tightening could continue to provide near-term support to risk assets. Voya recommends balancing risk-seeking positions with high-quality tilts.

Investment outlook

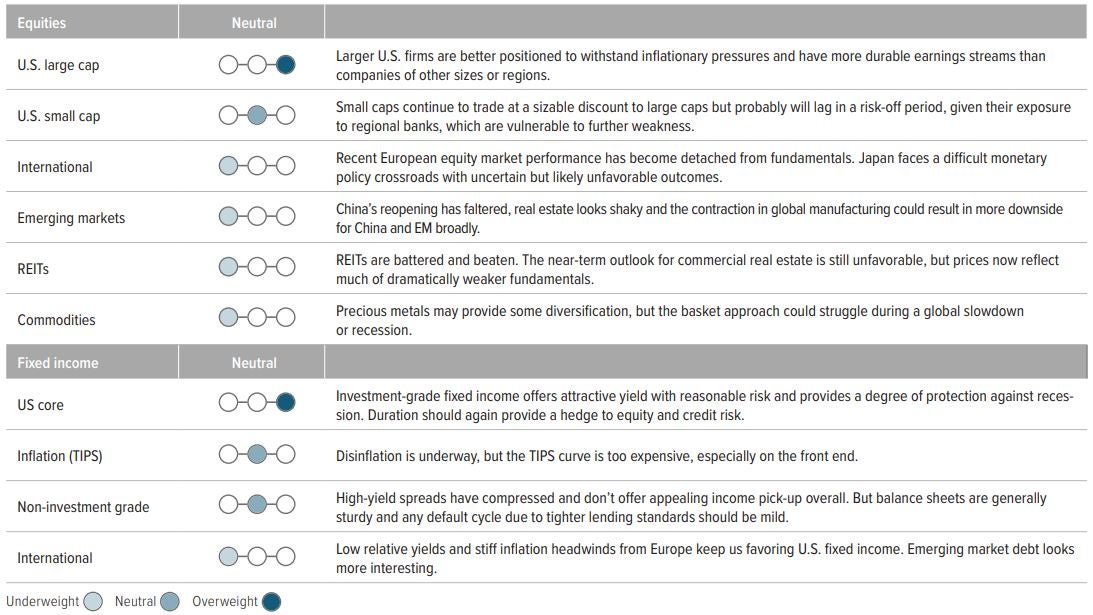

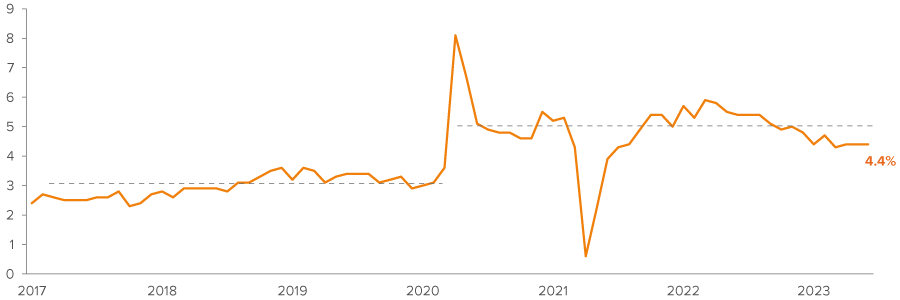

The U.S. economy has displayed remarkable resilience in the face of persistently high inflation, aggressive monetary tightening, banking sector stress and a standoff over the debt-ceiling limit. While the U.S. has thus far managed to avoid perhaps the most widely anticipated recession in history, growth is almost certain to slow and profit increases will be difficult to come by. Consumer spending continues to provide a sturdy foundation but will likely come under increased pressure as government pandemic assistance and the suspension of student loan repayments conclude. Already, the rate of change in consumers spending is moderating and credit card delinquency rates are rising, but not to a concerning degree. This is because the labor market and wages have held up well. The unemployment rate is still near cycle lows of 3.6%. Job openings are trending down but remain well above the number of unemployed. Initial jobless claims have been edging higher and the quits rate has declined, but the overall state of the jobs market remains tight. As a result, average hourly earnings are growing at a pace inconsistent with the Fed’s 2% inflation target (Exhibit 1). While indicators suggest wages are set to soften (Exhibit 2) and commodities, core goods and prices overall continue to cool, we believe the Fed isn’t ready to take its foot off the brakes yet.

As of 07/17/23. Source: Bloomberg, Goldman Sachs.

As of 06/30/23. Source: Bloomberg, Goldman Sachs.

As of 07/17/23. Source: Bloomberg, Voya Investment Management.

The bond market, finally acknowledging this view, has reversed course, with futures pricing out the possibility of interest rate cuts this year and now roughly falling in line with Fed projections. Besides higher rates for longer, stricter credit conditions following the regional bank crisis should tighten financial conditions ― which have yet to fully impact businesses and households. These factors support the disinflationary forces that are already in place. In our view, there are two variables that will weigh on inflation going forward: rents and used car prices. With respect to the former, the softening in demand should lead to declining prices across an array of discretionary services. For the latter, the steep drop in auto auction prices foretells the impending slump in inflation. The bottom line is that core inflationary pressures are fading alongside weaker economic growth. However, it doesn’t mean a recession is imminent or that it will be deep and painful.

Market participants’ recognition of cooling inflation and betterthan-expected macro data contributed to surprisingly strong first half equity market returns and, with stocks still under-owned in many investor portfolios, we think there is room for modest gains from U.S. large caps in the second half of this year. Valuations look reasonable (Exhibit 3) and earnings offer the potential for upside surprise as corporate sentiment improves and earnings guidance ratios are reaching their highest levels since 2021. We can’t write off potential disappointments, as the range of S&P 500 earnings forecasts is the widest it has been in decades, with a 50% gap between the highest and lowest year-end price targets; however, we believe strong U.S. fiscal balances should limit any potential economic downturn.

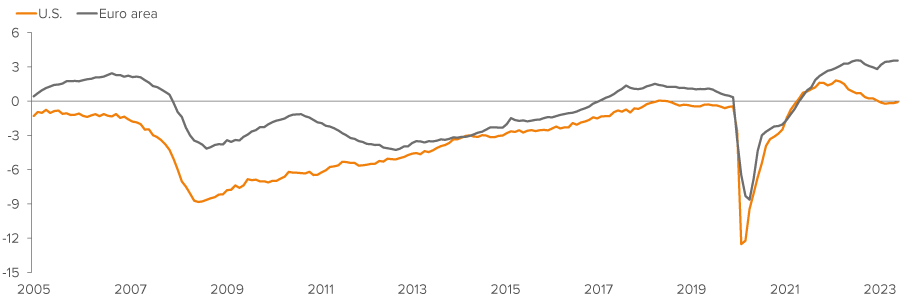

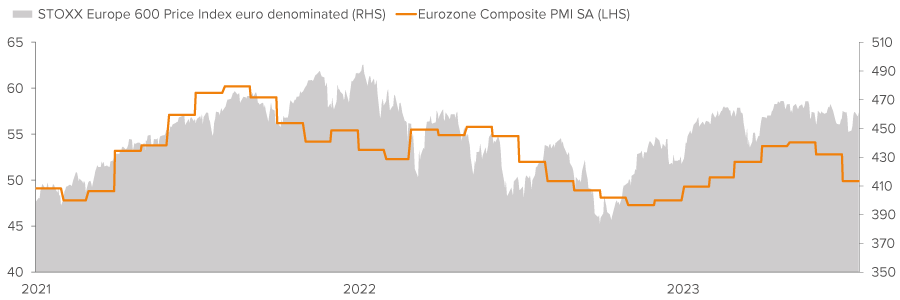

The outlook for Japanese equities has improved thanks to governance reforms that have led to higher foreign inflows and earnings revisions that are turning positive. Another potential source of return for foreign investors could come from a stronger yen should the Bank of Japan abandon yield-curve control and Ministry of Finance intervention. Still, we remain underweight international developed equities given our views on Europe, which lags the U.S. in the fight against inflation. What’s more, wages in Europe could be even stickier with labor’s relatively stronger bargaining power. While China’s economic slowdown could ease Eurozone price pressures on the margins, given the high correlation between the two economies, the European Central Bank still has more work to do. With policy rates set to move higher and economic momentum decelerating (Exhibit 4), we think most of Europe’s strong performance has already played out.

As of 07/17/23. Source: Bloomberg. The STOXX Europe 600 is an index of European stocks that has a fixed number of 600 components representing large-, mid- and small-capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone). Investors cannot invest directly in an index. Past performance is no guarantee of future returns.

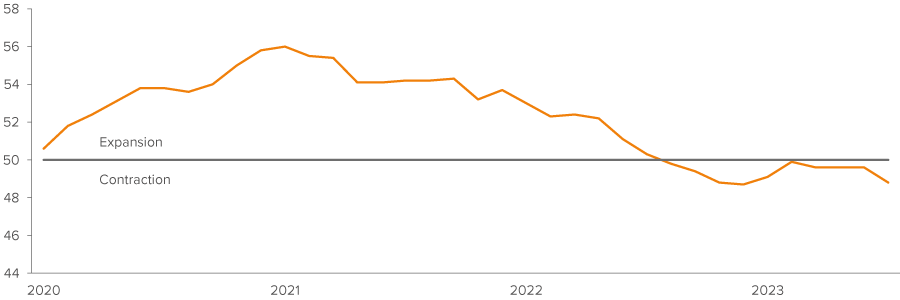

In China, frustrations linger — and according to our research could worsen. The post-pandemic economic reopening narrative has faltered, real estate looks shaky and the contraction in global manufacturing (Exhibit 5) could create a headwind for cyclical assets broadly, resulting in more downside for China specifically. In addition, after years of poor market performance, a negative wealth effect could exacerbate a liquidity trap where individuals hoard cash, making policy officials hesitant to aggressively stimulate. Yet, we think significant stimulus will be necessary to meaningfully boost asset prices, and incremental policy measures ultimately will fail. We believe China will reluctantly export deflation via a weaker currency, helping to nudge U.S. inflation lower and support the U.S. dollar (which has continued to weaken over the last month). This outlook accounts for our preference for domestic stocks. The move away from the dollar is clearly a long-term concern with foreign country reserves being rebalanced and trade arrangements reworked to “de-dollarize,” but the near-term ramifications have been overstated and the currency now appears to be trading in a fair range with the potential for a reversal should a global risk-off event occur.

As of 07/17/23. Source: Bloomberg.

Concerns about growth and credit losses are valid, as the effect of higher rates weigh more heavily on earnings and borrowers’ leverage ratios. As a result, we have tempered our long U.S. large cap position with underweights to the more economically sensitive areas of the equity market and favor higher-quality U.S. fixed income. We seek the yield pick-up from spread product, but in our view, it’s not worth reaching below investment grade, where most companies have locked in cheap long-term rates.