Weak global growth for the year ahead appears almost certain. The outlook for capital markets is anything but.

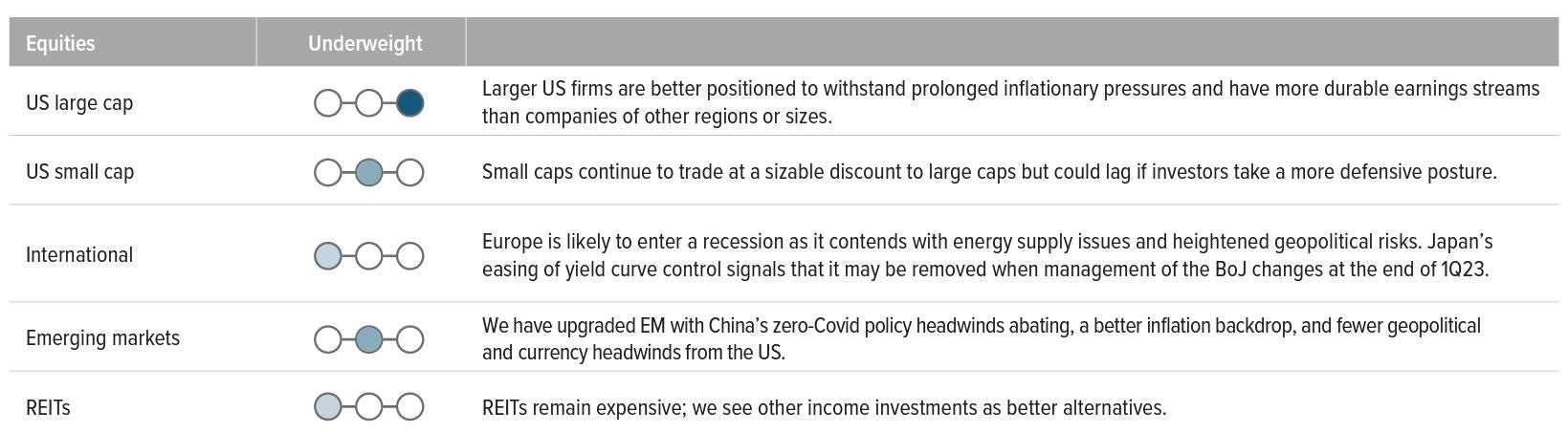

Tactical indicators

Economic growth (negative)

The US labor market has proven resilient in the face of aggressive monetary tightening, but other areas of the economy (housing, manufacturing, etc.) are struggling. We believe a mild, brief recession remains a risk in 2023, but growth for the full year may still be achievable.

Fundamentals (neutral)

Consensus earnings expectations for 2023 and 2024 seem overly optimistic given our relatively low growth outlook.

Valuations (positive)

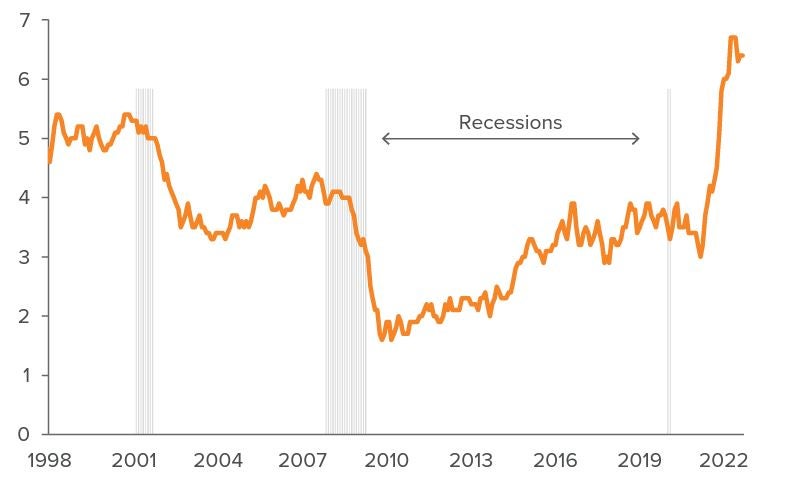

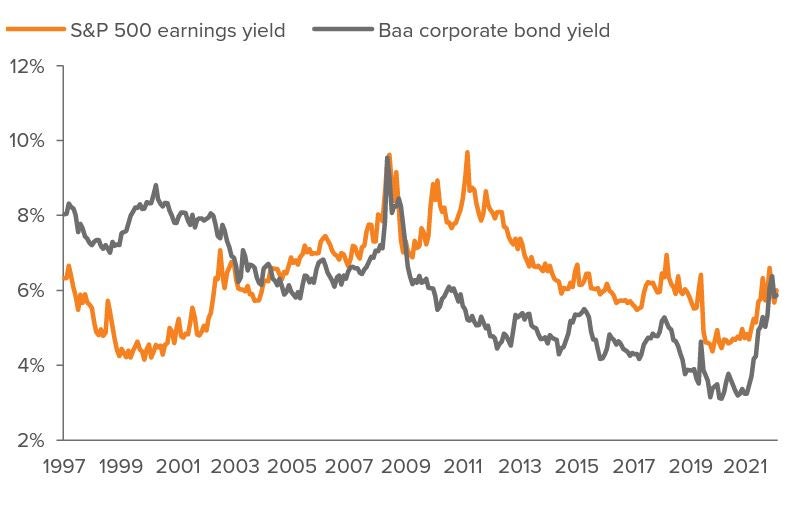

US equity valuations look reasonable, with forward P/E ratios hovering around their long-term average. But with corporate bond yields and equity earnings yields at similar levels (Exhibit 2), bonds look relatively attractive on a risk-adjusted basis.

Sentiment (neutral)

Some technical indicators have improved, but most institutional investors remain bearish on stocks, and the BofA Global Fund Manager Survey shows cash balances remain at historically high levels.

Stocks and bonds finish a hard 2022 on a high note. The major stock indexes overcame negative returns in December to end the fourth quarter with strong gains in what was otherwise an abysmal year. International stocks outperformed US equities, with Europe and the UK leading the way higher. Despite the continued negative overhang of the war in Ukraine contributing to energy supply challenges and painfully high inflation, the European region staged a remarkable rally.

Many signs suggest Europe is most at risk of a recession, but the costs of the energy supply shock haven’t been as bad as feared (yet) due in part to a warmer-than-usual winter. In addition, central banks have made it abundantly clear they are committed to stabilizing prices, which investors have viewed favorably. Moreover, and importantly for emerging markets, the US dollar sold off hard from its September peak, releasing some of the pressure that had built up over the epic period of strength that began in the first half of 2021.

The dollar weakness was welcome relief for non-dollar assets — and particularly for emerging market bonds, which generated large gains in the final three months of the year. Long-term US Treasury prices fell, whereas investment grade and high yield corporate bonds rose on tighter spreads.

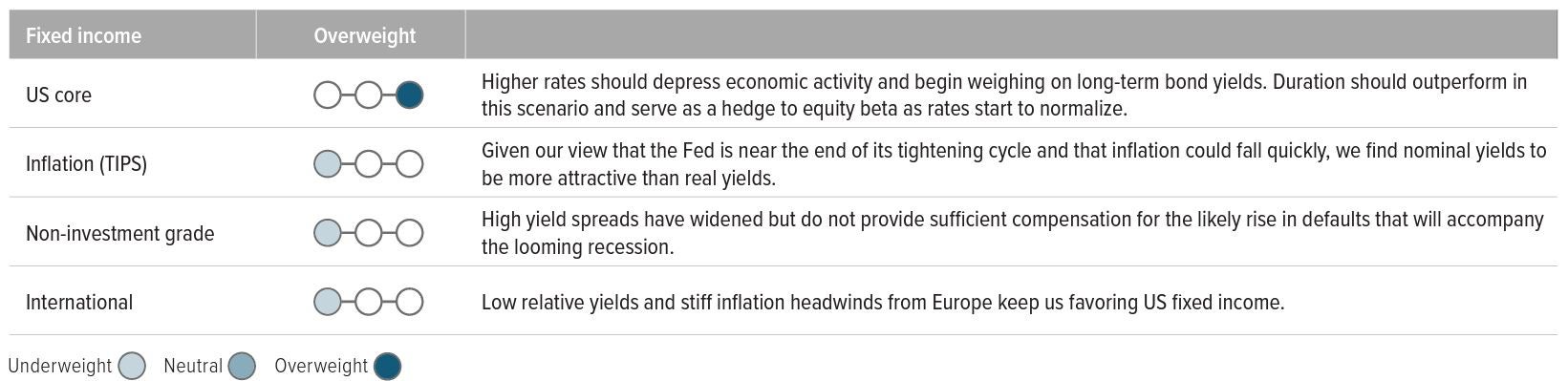

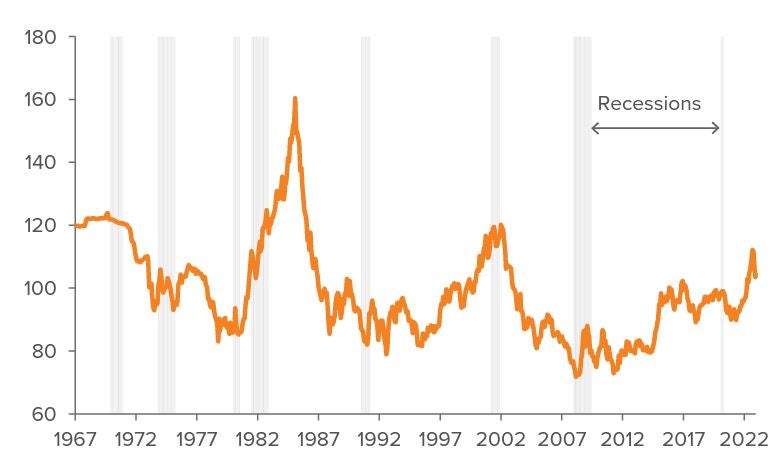

Inflation has peaked and should continue to head lower. Inflation progression and policymakers’ responses will continue to be among the principal global macro drivers in the year ahead. Although inflation remains unacceptably high, data suggests it has peaked, with meaningfully lower core goods and energy prices. Income-sensitive components of the price index baskets, such as shelter and services, are proving stickier given the still strong labor market and high personal income. However, we are beginning to see the effects of declining demand, with wage gains cooling (Exhibit 1), which we expect will continue. This combination will contribute to a steady fall in inflation to the low single digits by the end of the year.

Central banks are committed to their current paths. While we are confident inflation is moving in the right direction, developed market central banks have made it clear that they are not satisfied with their progress so far. We do not foresee a shift in the central bank policy prescription. With more tightening in store and explicit declarations that there will be no rate cuts in 2023, a contraction in developed market growth seems likely. Whether or not a US recession is formally affirmed, we are experiencing a slowdown that has impacted asset prices. The economy is likely to deteriorate further from here. We don’t anticipate an especially severe downturn, but instead think the second half of this year will see moderate inflation, more normal interest rates and slow but positive growth. Eventually, we think investors will come around to this view and that equities will begin to discount such a scenario. However, this picture seems a long way off given the challenging current macro environment facing stocks.

Equities face a host of challenges in 1H23 that keep us tactically underweight. Top-line revenues should fall along with demand, and the prolonged period of rising costs is likely to erode profit margins — including those of US large cap companies, which have thus far been relatively successful in maintaining pricing power. Although valuations are well off their peaks, US stocks aren’t cheap, with the forward P/E on the S&P 500 sitting around its 25-year average and corporate bond yields roughly equal to earnings yields (Exhibit 2). There are also numerous unresolved downside risks. In this setting, we conclude that a more tactical approach is warranted and hold a neutral position in stocks to maximize flexibility as we await more clarity.

As of 11/30/22. Source: Federal Reserve Bank of Atlanta. The Atlanta Fed’s Wage Growth Tracker is a measure of the nominal wage growth of individuals. It is constructed using microdata from the Current Population Survey (CPS) and is the median percent change in the hourly wage of individuals observed 12 months apart.

As of 01/04/23. Source: FactSet, JP Morgan, Moody’s, St. Louis Fed.

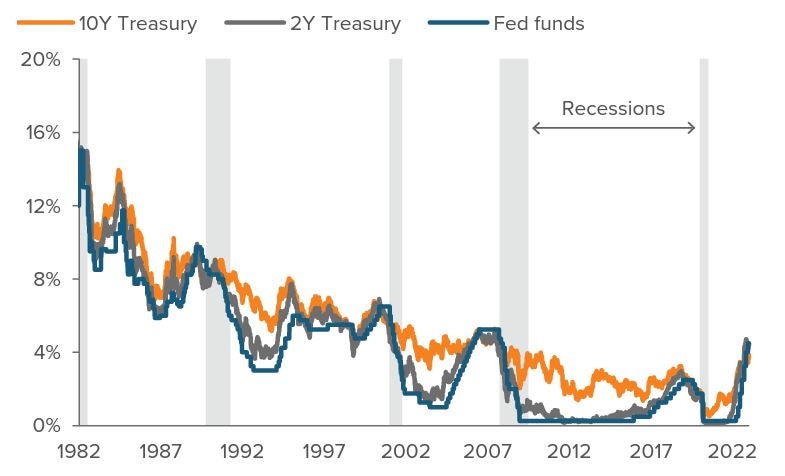

As of 01/04/23. Source: Bloomberg, Piper Sandler Companies.

As of 01/03/23. Source: Bloomberg.

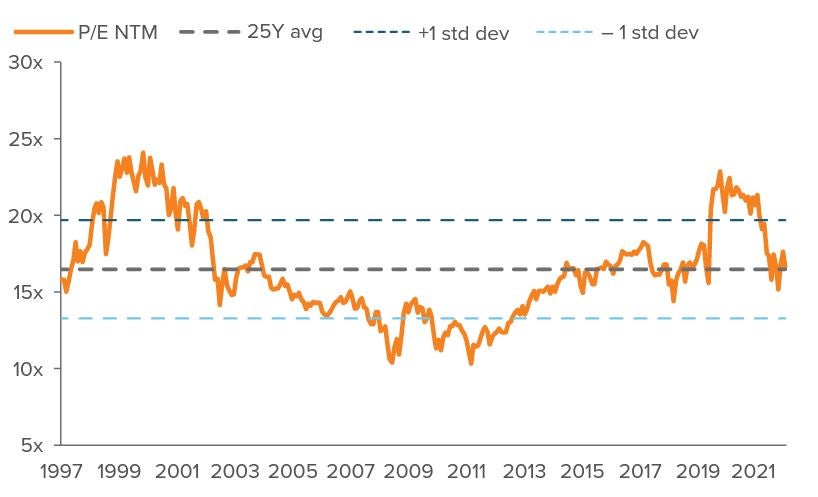

The bond bear market is likely over. Following one of the worst years on record, bonds now look attractive. Positive real yields across the interest rate curve present attractive carry for the first time in years. With the Fed hiking cycle near its end, we expect the handoff from inflation risk to growth risk should force yields lower (Exhibit 3), and we’ve therefore extended duration. Additionally, the volatility in rates and the correlation between stocks and bonds should normalize, helping bonds resume their role as a ballast within multi-asset portfolios.

The US looks comparatively favorable to its competitors. The US is further along in the inflation fight and still more geopolitically insulated compared to the Eurozone, which faces an increased probability of a decline in output. The strong fourth-quarter rally staged by European stocks only serves to further dissuade us from allocating more to the region.

China also closed out the year on a high note, but we are more upbeat on developments there. The move away from zero-Covid and the seeming relaxation of tensions with the US are positives. Furthermore, China hasn’t overheated like the rest of the world. This economic improvement makes emerging markets more attractive overall and offers the potential for a surprise to the upside. While the US dollar is less likely to be a headwind to international assets (Exhibit 4), the currency should retain its defensive properties in risk-off scenarios.

In sum, we believe the global economic slowdown will make 2023 more difficult than 2022 for individuals and companies, especially if there an outright recession unfolds. However, we are confident that long-only multi-asset investors will have a more friendly environment in which to operate and that globally diversified mixes of stocks and bonds should make up the lion’s share of most portfolios (despite the lack of diversification benefits last year). We believe it is an approach that should continue to pay off in the long run.