In an uneven macro environment, we emphasize balance in our multi-asset portfolios, favoring U.S. large cap equities and high-quality fixed income.

Quick take

Valuations and optimism about rate cuts could limit upside potential for equities

While we are encouraged by the progress of inflation and the resilience of consumers and corporations, we believe that noticeably slower economic growth, fair to modestly extended valuations, and optimistic forecasts regarding Fed rate cuts could limit the upside potential for stocks.

U.S. outperformance can persist

We think U.S. equities will continue to outperform other countries and regions, driven by the strength of the U.S. consumer and superior corporate earnings growth from unrivaled innovation.

Balanced portfolio positioning

The current market backdrop presents opportunities for allocators to benefit from divergences in global policy, business cycles and pricing of risk. However, in this uneven macro environment, we emphasize balance in our multi-asset portfolios, favoring U.S. large cap equities and high-quality fixed income.

Tactical indicators

Economic growth (slowing)

U.S. economic growth is slowing but continues to hold up better than expected as financial conditions ease and labor markets remain tight into 2024. We believe below-trend growth is needed to pull inflation down to the Fed’s 2% target and they are intent on achieving that objective.

Fundamentals (neutral)

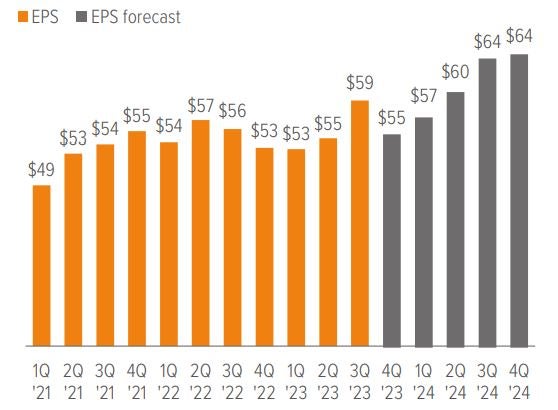

After strong Q3 2023 results, the early read on Q4 S&P 500 earnings growth is underwhelming, as profit margins are coming in thin. While 2024 EPS expectations are being revised lower, we think the year ahead will see modest single digit earnings growth.

Valuations (neutral)

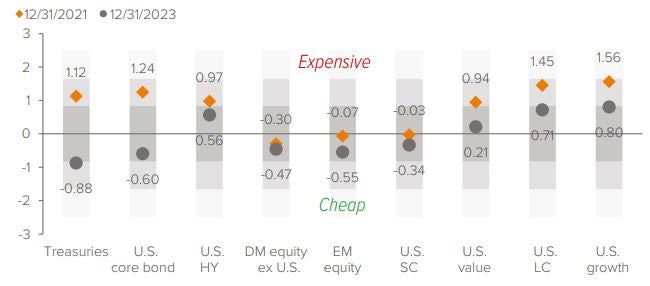

In aggregate, large cap U.S. equity forward earnings multiples are above their historical average (Exhibit 1), but strong corporate cash flows support the valuation. Small cap and non U.S. equities are cheap, but weaker fundamentals warrant discounts.

Sentiment (extended)

Investors started the year optimistic, anticipating considerable cuts to the fed funds rate. Expectations for monetary support have been tempered since, yet the S&P 500 set a new all-time high.

As of 12/31/23. Source: Bloomberg, JPMorgan, Voya IM.

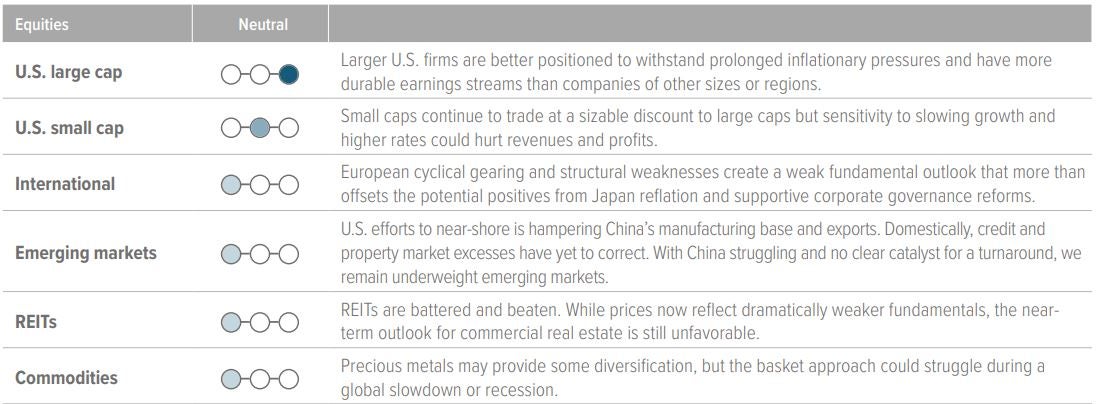

Portfolio positioning

We remain balanced in views on global stocks versus bonds. U.S. large cap equities and high-quality fixed income are our favorite asset classes.

Investment outlook

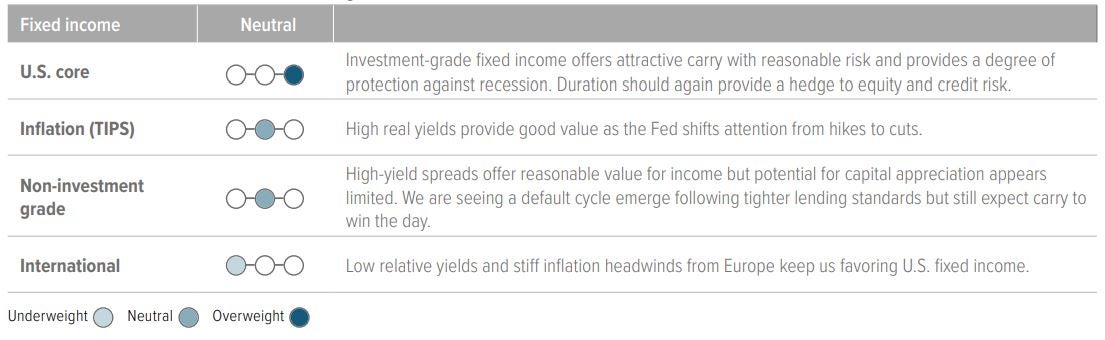

After unexpectedly strong performance from the U.S. economy and capital markets last year, investors enter 2024 more upbeat. While we are encouraged about the progress of inflation and the resiliency of consumers and corporations, we think noticeably slower economic growth, fair to modestly extended valuations and optimistic forecasts around Fed rate cuts (Exhibit 2) could limit upside potential for stocks. We see rates markets are providing little room for yields to decline outside a meaningful slowing of economic growth. Despite high expectations, we think global stocks and bonds can produce respectable returns throughout the year. The current setting presents opportunities for allocators to benefit from divergences in global policy, business cycles and pricing of risk. In this macro environment, we emphasize balance in our multi-asset portfolios, but believe U.S. exceptionalism is set to persist.

As of 1/8/24. Source: Bloomberg, JP Morgan, Voya IM, as of 1/8/24.

Disinflationary process continues

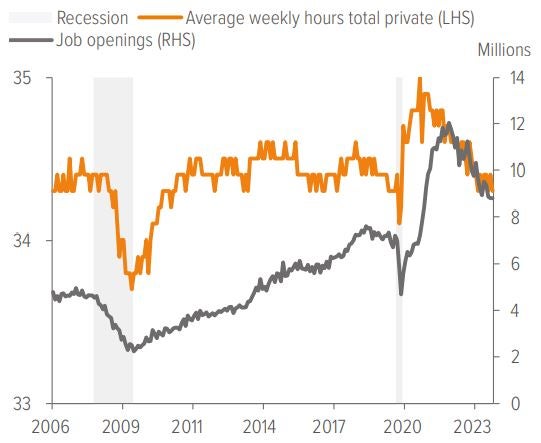

Since peaking at 5.6% in February 2022, core personal consumption expenditures (PCE) inflation has trended sharply lower, dropping to 3.2% year-on-year in November (Exhibit 3). Supply chain issues have eased considerably. Slowing demand-side forces have accounted for most of the recent relief, and we see more downside from factors such as shelter, where market rents suggest a clear trajectory towards 2.0-3.0% in 2024. Core services ex-housing remains a concern for the Fed. Transportation services like auto insurance and repair costs are a source of heat, but could decline if vehicle and auto parts prices start to fall. Additionally, weaker wage growth and consumer spending is expected as the lagged impact of tighter monetary policy further filters into the labor market, where there are early signs of softening–such as declining job openings and hours worked (Exhibit 4).

As of 11/30/23. Source: U.S. Bureau of Economic Analysis, Federal Reserve Bank of St. Louis.

As of 12/31/23. Source: Bloomberg.

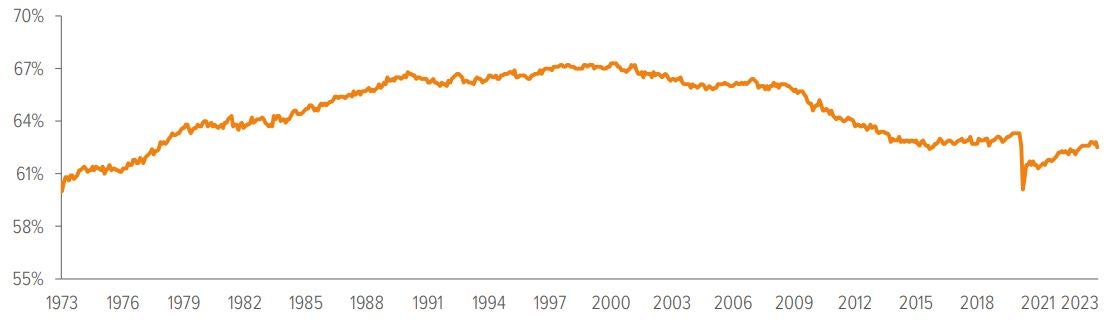

Labor markets cooling. Despite our slow growth outlook and belief that unemployment will rise modestly from its current 3.7%, we don’t expect significant deterioration in the labor market. Limited private sector overreach and rising real incomes from falling inflation should keep the growth slowdown mild. Furthermore, the U.S. faces structurally lower labor force participation with the aging population (Exhibit 5), which supports labor demand. Also, after the pandemic highlighted talent shortages, companies may be marginally less inclined to fire. In this soft-landing scenario, U.S. fundamentals should hold up relatively well.

As of 11/30/23. Source: U.S. Bureau of Economic Analysis, Federal Reserve Bank of St. Louis.

U.S. outperformance can persist. Looking ahead, estimates suggest year-over-year U.S. corporate earnings growth will be positive in 2024, accelerating in the back half of the year (Exhibit 6). We think U.S. equities will continue to outperform other countries and regions, driven by the strength of the U.S. consumer and superior corporate earnings growth from unrivaled innovation. The U.S. profit recession front-ran the U.S. economic recession that never happened. Proactive corporate right-sizing left earnings in a position to accelerate quickly off the trough and should support earnings growth ahead. Current estimates are for S&P 500 earnings growth of about 10% in 2024. We acknowledge the risk to earnings appears skewed to the downside due to rising financing costs and dampened demand, but in our view, high single digits is achievable. Returns would be roughly the same should valuations remain unchanged, which seems realistic given they are only moderately expensive versus history (Exhibit 7), and our belief in the continuance of a U.S. equity premium arising from numerous advantages and a lack of compelling alternatives.

As of 12/31/23. Source: FactSet

As of 1/5/24. Source: Bloomberg.

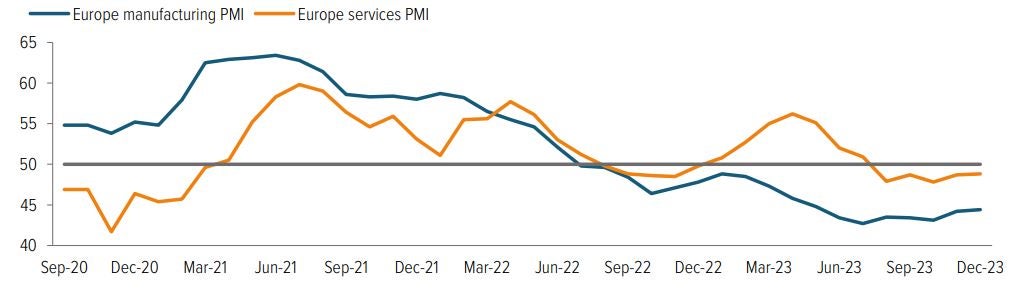

European economic momentum has weakened since Q1 2023. Eurozone purchasing manager indexes (PMIs) have been in contraction territory for both the manufacturing and services sectors since the summer. Europe’s cyclical gearing, sector composition–heavily weighted in financials–and substantial floating-rate debt and adjustable-rate mortgages make the region more interest-rate sensitive than the U.S. This has made the sting from tighter policy more broadly felt. Additionally, elevated exposure to energy supply shocks and reliance on external demand from China enhance the case for remaining underweight Europe.

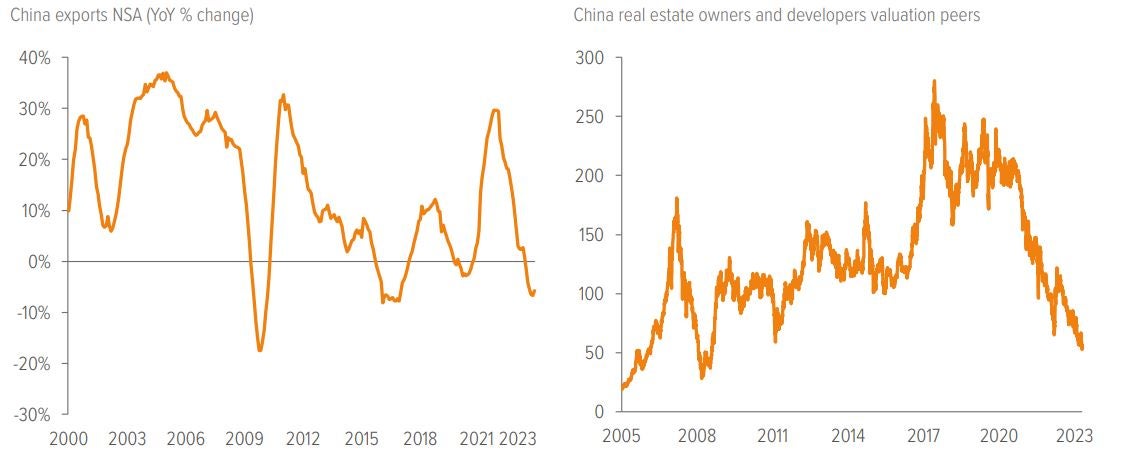

Emerging markets contain bright spots and are cheap, but China’s headwinds remain. With emerging markets continuing their long string of underperformance against developed markets, relative valuations have moved to alluring levels, mainly due to China. Tensions with the U.S. have driven a decoupling of the world’s two largest economies, hampering China’s manufacturing base and exports (Exhibit 9, left side). Domestically, authorities have been struggling to address credit and property market excesses that we think have yet to fully correct (Exhibit 9, right side) and indicate that the country is falling deeper into a liquidity trap. In this position, it has become increasingly difficult to stimulate, and policymakers have been reluctant or unable to step up efforts on this front. While emerging market equities are cheap and other countries appear to be in better shape and beneficiaries of western companies’ efforts to dissociate with China (e.g., India, Mexico, etc.), our opinion of the asset class is tied to the fortunes of China, and we don't see a clear catalyst for a rebound there. So again, we continue to favor the U.S., both on the equity and fixed-income side.

As of 11/30/2023, 1/4/24. Source: Bloomberg.

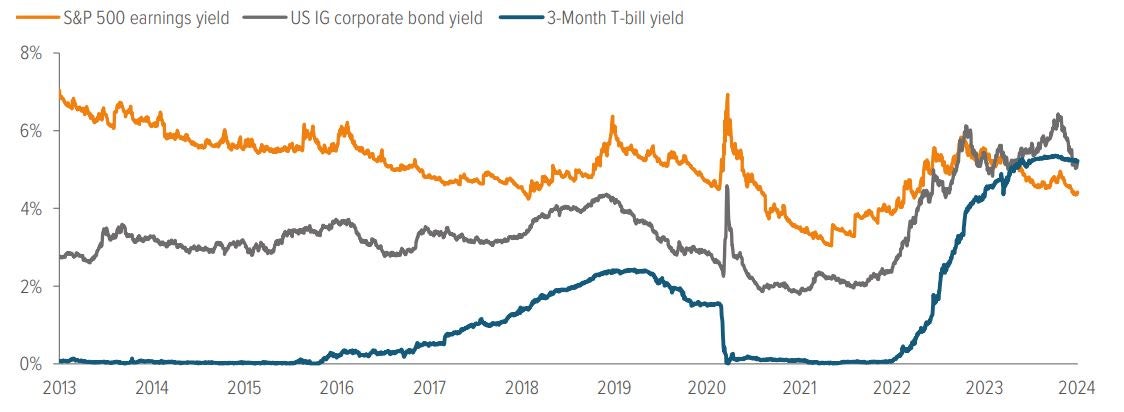

Bonds and balance. We emphasize balance across asset allocation as competition from improving valuations and portfolio utility across asset classes means equities are no longer the only game in town (Exhibit 10). Even after the sharp decline in yields, fixed income still offers attractive carry within the high-quality space. Investors don’t need to reach for yield as cash yields remain the highest in over twenty years. Moreover, bonds should perform well in the event of a recession, (which isn’t our expectation, but could certainly happen). Duration should also resume its historically negative relationship with stocks, providing diversification in either the recession or slow-growth scenarios. The major risk to bonds is that inflation reignites, and the Fed is forced to retrench into a hawkish stance and raise rates, which is also not our view. In this scenario, cash would probably do well, but what seems more likely to us is that the Fed cuts multiple times and inertia starts to take hold over investors sitting on piles of dry powder. Therefore, we advocate releasing most ammunition into assets with higher return potential.

As of 1/4/24. Source: Bloomberg.

|

A note about risk Certain of the statements contained herein are statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All investments are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) increasing levels of loan defaults, (5) changes in laws and regulations and (6) changes in the policies of governments and/or regulatory authorities. |