Get the latest insights from our securitized credit desk.

Equity markets back to the highs, credit spreads testing the tights and measurably positive total returns for holders of duration… what a quarter it was! Looking forward, we are staring down a gauntlet of macro data expected to show weakening growth, as well as the deadline of the great reprieve. A pessimist would say look at all the derailers… but with securitized markets hitting on most cylinders, we say pick your spots and take some risk.

Macro Inputs

- Tariff Sheriff and Fiscal Policy: While still a key component of any credible market strategy, policy uncertainty was discounted within markets over the course of the quarter. The 90-day reprieve, trade deals with the UK and China and emergence of fiscal policy generally regarded as pro-growth promoted market healing. However, a lack of trade deals going into July 9th (expiration of the reprieve from reciprocal tariffs) may drive “fresh” trade related fears in coming days. On the fiscal side of the policy dimension, the unfortunate timing of these notes comes at a still unsettled moment: at press time for our notes, the mega-bill on tax and spending cleared the Senate but is back to the House for consideration. While our base case is for approval, the narrow margin (3 votes some suggest!) suggests ultimate passage has to be regarded as uncertain. Should the bill ultimately pass and get signed into law, we expect the market to appreciate a dose of refreshing certainty, despite the negative implications for the country’s deficit (CBO estimate >$3T over the next 10 years), low-income consumer cohort and the clean energy sector.

- Feedback loops into securitized markets have been mainly indirect, beyond the day-to-day gyrations in bond markets, which, arguably, have been more driven by the Fed in June. Volatility, accordingly, has been very low in our credit sectors despite the drama in DC.

- While not a securitized credit market, even the agency RMBS market exhibited lower volatility in June. The market seemed to trade better during the month as implied rate vol remained lower (MOVE index ended the month well under 100, at 90) and treasuries rallying (10s -17bps during June).

- US Labor and CPI: Following solid April prints, May Payrolls and CPI again both came in favorably from our perspective, evidencing an economy not [yet] disrupted by the policy uncertainty. The headline payroll # surprised consensus slightly to the upside (+139K vs +126K expected) and the unemployment rate stayed stable (4.2%) - neither too hot nor too cold. CPI retreated, with the headline and core both posting downside surprises: headline +0.1% MoM vs +0.2% expected and core +0.1% vs +0.3% expected. In each case, we assessed market reactions as modest relative to policy and the Fed, but certainly contributed to the positive sentiment and continuing repair in markets.

- Similar to May, securitized markets had little to price after these reports, with market affinity for risk assessed as based more on continuing comfort from the trade war reprieve and, perhaps more importantly, the shift in headlines to more growth friendly policies embedded in the afore described bill. While more dovish takes from Fed officials have seeped into rate markets, we continue to expect that this ‘resilient’ hard data will likely keep the Fed on hold near term, not ideal for CMBS and RMBS (weaker refi impulses keep transaction de-leveraging slow) but good for income generation, particularly in floating rate sectors like CLOs and CRT. .

- Fed: While the Fed meeting itself failed to materially move markets (10yr ~flat), the Fed became decidedly more relevant in markets during June from our perspective. A decidedly dovish tilt from 2 FOMC participants got media focus post meeting, alongside more rhetoric from Trump regarding a replacement for Powell next year. The rates market seemed to react to each, with rates rallying somewhat sharply over the final weeks of the month (10s -16bps from 6/18-6/30).

- As alluded to above, securitized markets (like other risk markets) prefer lower rates and lower rate vol, so these developments are overall well received, especially in mortgage sectors. However, the updated ‘dot plot’ suggests a Fed that has a sizeable hawkish cohort; accordingly, we view the recent move to price in a more dovish Fed as quite vulnerable and aren’t repositioning around it.

Liquidity has remained strong and deep in securitized markets, dismissing the traditional pullback around quarter-end to continue to support issuance and trading activity. This is particularly true in primary markets, where new issuance has been the dominant place to source risk, and execution remains extremely efficient. Secondary market trading volumes were lower month over month, with reduced selling pressure across sectors, especially in CRT and CLOs (ETF selling a distant memory).

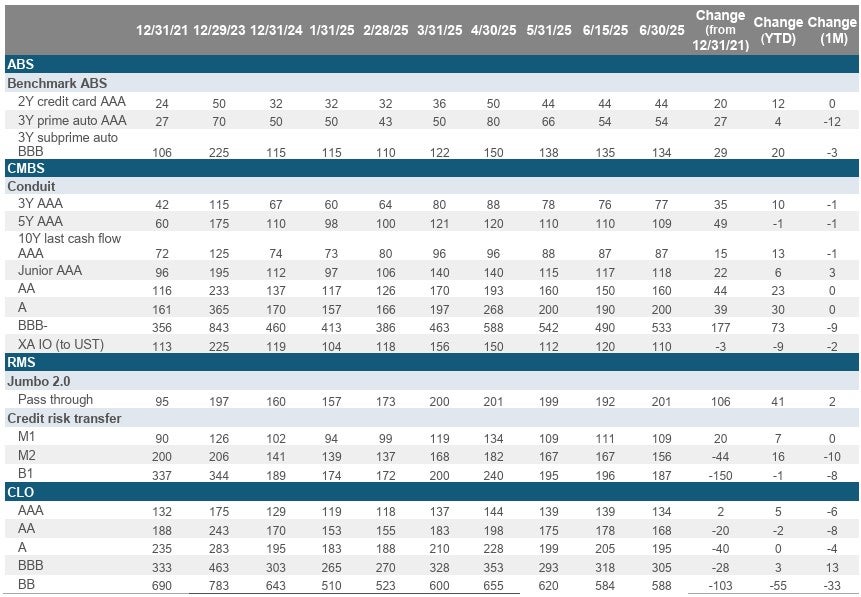

- Perhaps predictably, spreads have benefited, with CLOs, CMBS and CRT leading the way. ABS and non-Agency RMBS have participated, but the resulting spread tightening has been a little more muted.

- As we highlighted last month, the spread moves have favored subordinate parts of the capital structure, a characteristic of risk-on markets with deep liquidity, and correlated with risk-on moves in other markets. However, when we compare the overall magnitude of spread moves enjoyed in securitized markets, they have lagged other markets. This is also in keeping with ‘typical’ behavior in securitized markets, where lower volatility tends to manifest in both risk-on and risk-off markets as correlations are often positive but the magnitude of day-to-day moves decidedly less. When we reflect on the nature of the moves and surrounding dynamics, we don’t see distortions having emerged and remain constructive on rel-val.

- From a buyer type perspective, after we highlighted the return of insurance flows in May, we didn’t note new dynamics in June. Total return-oriented buyers (money managers, hedge funds) continued to participate, as did insurers.

- On our radar, but not necessarily visible in securitized credit flows, are banks. The potential return of less price sensitive buyers has been a source of upside in securitized markets after a multi-year period of reduced participation. With the deregulation side of the policy dimension emerging (see recent changes to the SLR calculation), we will continue to watch closely for this potential new source of flows.

- As highlighted above, primary market activity has been extremely active and efficient. Market participants at our most involved broker-dealers were initially cautious around June’s sizeable pipeline of transactions. However, around mid-month, that caution quickly turned to enthusiasm, extoling accounts to ‘get involved’ as deals moved quickly and order sizes were regularly allocated lower into oversubscribed order books.

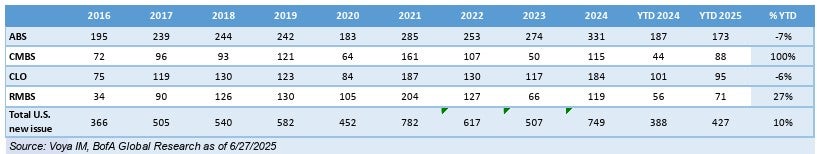

- On a sector level, we again highlight the continued faster pace of issuance in CMBS (+100% YoY), with the space continuing to evidence a transition to a sustainable recovery from the crisis like conditions in 2022-2023. We would also highlight the pick-up in non-agency RMBS volumes (+27% YoY), which is modestly surprising given the sustained higher mortgage rate back-drop. While it will require an even stronger 2H to outpace full year 2024 new issuance, the underpinnings of investor demand seem in place from our perspective.

- Conversely, the pace of issuance in non-mortgage sectors has been lower YTD. We are hesitant to attribute the decline, given the levels absorbed are still robust when viewed over a longer-term historic perspective. While ‘the arb’ in CLOs is clearly tighter, and perhaps banks have curtailed public ABS issuance YTD, these sectors remain active and a source of scalable risk for investors.

Outlook

- Despite the ‘extended’ feel of valuations in equity markets (S&P 500 ended June at a new record!), we remain comfortable with the relative value offered in securitized markets. As characterized above, spreads have continued to tighten through June, despite remaining policy uncertainty and a Fed that has a hawkish lean. However, the move has been more muted than other risk markets, leaving rel-val intact. With key securitized risks in consumer credit and US real estate (both commercial and residential) overall well underpinned, we assess fundamentals as supportive for risk taking. Layering in potential upside from a regime shift in the policy mix to more pro-growth arenas like tax cuts and deregulation, a risk-on lean in our markets seems the path of least resistance for now. .

Here is to a great summer for all our readers and a great 2H in markets!

Voya Securitized Team