Weekly Notables

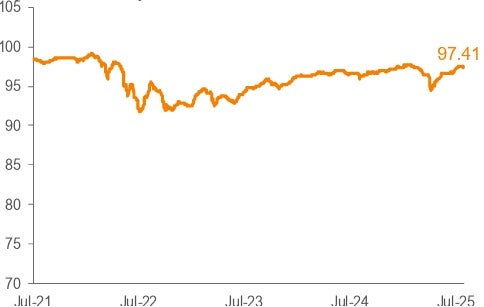

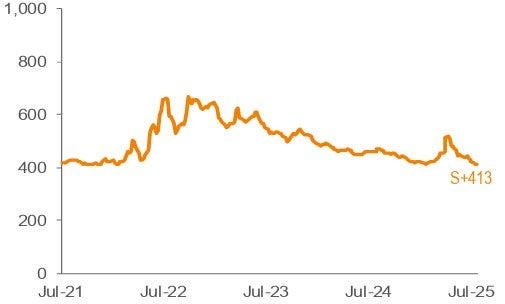

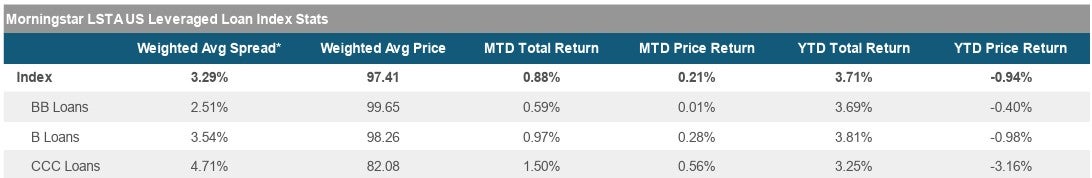

The loan market continued to soften this week, as the weighted average bid price of the Morningstar LSTA US Leveraged Loan Index (Index) slipped by another thirteen basis points (bps) to 97.41. This was largely due to the heavy refinancing and repricing volume which is putting some modest pressure on secondary trading levels. Still, the Index delivered a positive return of 0.01% for the seven-day period ending July 31, driven by coupon carry.

After one of the busiest weeks on record, the leveraged loan primary market ebbed but remained active overall. New issue volume dipped slightly to $13.5 billion, with a notable swing to dividend recaps which account for 37% of new supply. Refinancing and LBO/M&A accounted for 50%, while repricing cooled to $32.2 billion across 25 transactions. Looking ahead, net of approximately $30 billion of anticipated repayments that aren’t associated with the forward calendar, repayments outstrip supply by roughly $12 billion, compared to repayments outstripping supply by $13.2 billion last week.

Trading in the secondary market remained active, but the rally slowed this week amid a slew of loan issuer earnings stories. Single-B’s held in, while BB and CCC issuers saw a decline in average bids.

CLO managers priced eight new deals this week, bringing the YTD tally to an impressive $122.2 billion. Retail loan funds recorded a net outflow of $20 million for the week ending July 30, according to Morningstar.

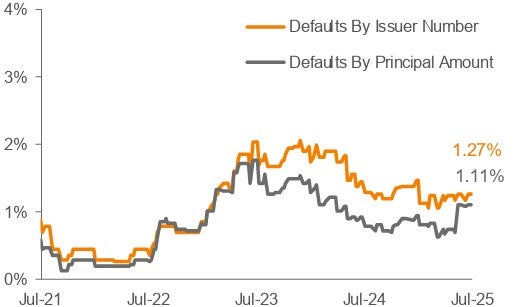

There were no defaults in the Index this week.

Source: Pitchbook Data, Inc./LCD, Morningstar LSTA US Leveraged Loan Index. Additional footnotes and disclosures on back page. Past performance is no guarantee of future results. Investors cannot invest directly in the Index. *The Index’s average nominal spread calculation includes the benefit of base rate floors (where applicable).