From 2022-2023, would-be issuers of high yield bonds held off, waiting for conditions to improve. That time may have come.

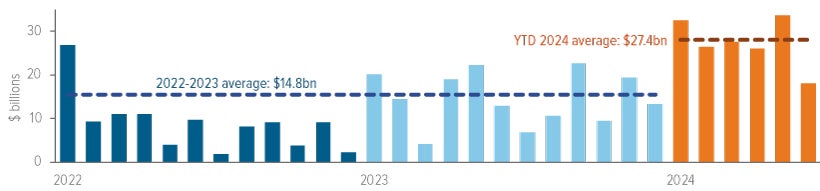

When rates began moving higher in 2022, interest expense for new corporate debt climbed higher as well. As a result, new corporate debt issuance dropped and stayed low (Exhibit 1). Moreover, the heavy volume of refinancing at record low rates in late 2020 and 2021 enabled many companies to extend durations and avoid issuing substantial new debt.

All this started to change in 2024. High yield issuance has picked up as companies began refinancing shorter duration near term maturities. (In 2024, 78% of proceeds from new issuance has been used for refinancing— on track to be the highest level in more than two decades.1 )

This adds to the overall positive backdrop for short duration high yield bonds. Higher liquidity can make trading easier, improve price accuracy, increase market efficiency and help reduce volatility.

As of 06/30/24. Source: BofA Global Research. Chart shows developed market U.S. dollar high yield bonds.

A note about riskDebt instruments: Debt instruments are subject to greater levels of credit and liquidity risk, may be speculative, and may decline in value due to changes in interest rates or an issuer’s or counterparty’s deterioration or default. High yield fixed income securities: There is a greater risk of issuer default, less liquidity, and increased price volatility related to high yield securities than investment grade securities. Market volatility: The value of the securities in the portfolio may go up or down in response to the prospects of individual companies and/ or general economic conditions. Price changes may be short or long term. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the portfolio and its investments, including hampering the ability of the portfolio’s manager(s) to invest the portfolio’s assets as intended. Issuer risk: The portfolio will be affected by factors specific to the issuers of securities and other instruments in which the portfolio invests, including actual or perceived changes in the financial condition or business prospects of such issuers. Interest rate risk: The values of debt instruments may rise or fall in response to changes in interest rates, and this risk may be enhanced for securities with longer maturities. Credit risk: If the issuer of a debt instrument fails to pay interest or principal in a timely manner, or negative perceptions exist in the market of the issuer’s ability to make such payments, the price of the security may decline |