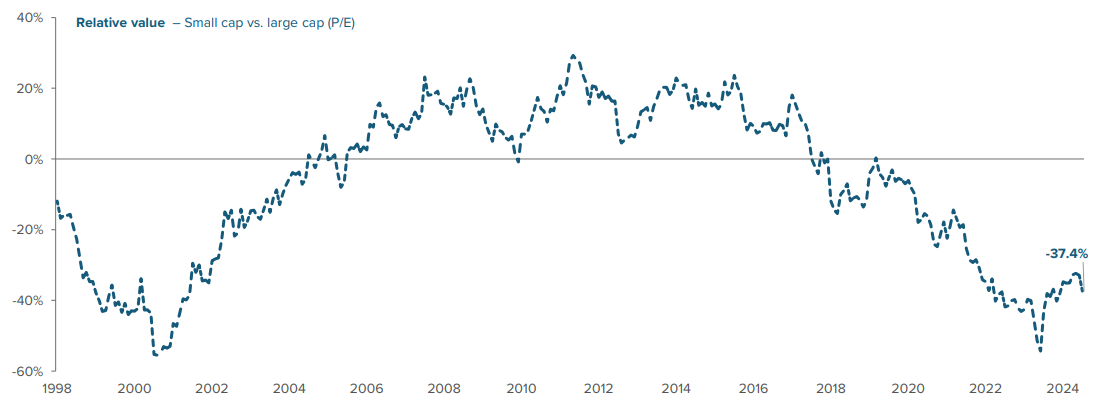

Following sharp compression in earnings multiples year to date, U.S. small cap growth stocks are at their cheapest levels relative to large cap growth stocks since January 2001. Is now the time to reassess exposure to large cap growth in favor of small cap growth? We see reasons to consider U.S. small cap growth right now.

As of 06/30/24. Source: FTSE Russell, Voya Investment Management. P/E: Trailing 12-month price/earnings ratio, based on the Russell 2000 Growth Index (small cap) and Russell 1000 Growth Index (large cap). Past performance does not guarantee future results. Investors cannot directly invest in an index.

Product Facts

| Ticker Symbol | VWYFX |

| CUSIP | 92918A782 |

| Inception Date | October 7, 2022 |

| Dividends Paid | Annually |

| Min. Initial Investment | $1,000.00 |

About this Product

- Invests primarily in stocks of smaller, lesser-known U.S. companies which fall within the range of the Russell 2000 Growth Index

- Seeks companies with superior revenue and earnings potential that are trading at sustainable valuations

- Consistently applied philosophy and process across various market cycles driven by bottom-up fundamental analysis

- Diversified, high quality, risk adjusted portfolio seeking to outperform the Russell 2000 Growth Index

Investment Objective

The Fund seeks capital appreciation.

Performance

Average Annual Total Returns %

As of April 30, 2025

As of March 31, 2025

| Most Recent Month End | YTD | 1 YR | 3 YR | 5 YR | 10 YR | Inception | Expense Ratios | |

|---|---|---|---|---|---|---|---|---|

| Gross | Net | |||||||

| Net Asset Value | -13.83 | -1.63 | +5.15 | +10.53 | +9.19 | — | 1.26% | 1.26% |

| With Sales Charge | -18.79 | -7.30 | +3.09 | +9.23 | +8.54 | — | ||

| Net Asset Value | -11.25 | -4.56 | +2.10 | +14.33 | +9.11 | — | 1.26% | 1.26% |

| With Sales Charge | -16.35 | -10.05 | +0.10 | +12.98 | +8.47 | — | ||

| Russell 2000 Growth Index | -11.68 | +2.42 | +5.05 | +7.60 | +6.39 | — | — | — |

| Russell 2000 Growth Index | -11.12 | -4.86 | +0.78 | +10.78 | +6.14 | — | — | — |

Inception Date - Class A: October 7, 2022

Current Maximum Sales Charge: 5.75%

The performance quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. The investment return and principal value of an investment in the Portfolio will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. See above "Average Annual Total Returns %" for performance information current to the most recent month-end.

Returns for the other share classes will vary due to different charges and expenses. Performance assumes reinvestment of distributions and does not account for taxes.

Total investment return at net asset value has been calculated assuming a purchase at net asset value at the beginning of the period and a sale at net asset value at the end of the period; and assumes reinvestment of dividends, capital gain distributions and return of capital distributions/allocations, if any, in accordance with the provisions of the dividend reinvestment plan. Net asset value equals total Fund assets net of Fund expenses such as operating costs and management fees. Total investment return at net asset value is not annualized for periods less than one year.

The Russell 2000 Growth Index is an unmanaged index that measures the performance of smaller U.S. companies with greater-than-average growth orientation. It is a small-cap stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index.

Past performance does not guarantee future results.

Growth of a $10,000 Investment

For the period 10/07/2022 through 04/30/2025

Ending Value: $12,522.00

The performance quoted in the "Growth of a $10,000 Investment" chart represents past performance. Performance shown is without sales charges; had sales charges been deducted, performance would have been less. Ending value includes reinvestment of distributions.

Portfolio

Portfolio Statistics

As of April 30, 2025

| Net Assets millions Net Assets: The per-share dollar amount of the fund, calculated by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding. | $1,197.1 |

| Number of Holdings Number of Holdings: Number of Holdings in the investment. | 99 |

| P/E next 12 months P/E: P/E (next 12 months) calculates the price of a stock divided by its earnings per share. | 24.71 |

| P/B trailing 12 months P/B: Price to book ratio (trailing 12 month) calculates the ratio of a stock’s price to its book value. | 5.30 |

| Weighted Average Market Cap millions Weighted Average Market Cap: Weighted Average Market Capitalization is the value of a corporation as determined by the market price of its issued and outstanding common stock. | $5,638.9 |

| EPS Growth (3-5 Year Estimate) EPS Growth (3-5 Year Estimate): The portion of a company's profit allocated to each outstanding share of common stock. EPS growth serves as an indicator of a company's profitability. | 15.12 |

| Active Share Active Share: Active Share is a measure of the percentage of stock holdings in a manager's portfolio that differ from the benchmark index. | 79.43 |

| Price to Cash Flow Price to Cash Flow: The ratio of a stock’s price to its cash flow per share. The price-to-cash flow ratio is an indicator of a stock’s valuation | 26.62 |

| ROA % ROA: ROA is an indicator of how profitable a company is relative to its total assets. ROA gives an idea as to how efficient management is at using its assets to generate earnings. | 2.01 |

| Total |

Top Holdings

% of Total Investments as of April 30, 2025

| WNS (Holdings) Limited | 2.26 |

| Western Alliance Bancorp | 2.20 |

| ACI Worldwide, Inc. | 2.20 |

| Carpenter Technology Corporation | 2.13 |

| Casella Waste Systems, Inc. | 2.08 |

| Rambus Inc. | 2.05 |

| Champion Homes, Inc. | 1.97 |

| Ensign Group, Inc. | 1.86 |

| Kratos Defense & Security Solutions, Inc. | 1.79 |

| Clean Harbors, Inc. | 1.70 |

| Total | #,###.2 |

Portfolio Composition

as of April 30, 2025

| Mutual Funds | 0.52 |

| EM Equity | 3.48 |

| Foreign Stocks | 4.58 |

| Cash | 4.35 |

| US Common Stocks | 87.06 |

| Total | #,###.2 |

Top Sectors

% of Total Investments as of April 30, 2025

| INDUSTRIALS | 28.26 |

| HEALTH CARE | 27.48 |

| INFORMATION TECHNOLOGY | 20.29 |

| CONSUMER DISCRETIONARY | 9.76 |

| FINANCIALS | 6.47 |

| MATERIALS | 3.50 |

| CONSUMER STAPLES | 2.64 |

| ENERGY | 1.26 |

| REAL ESTATE | 0.34 |

| COMMUNICATION SERVICES | 0.00 |

| UTILITIES | 0.00 |

| Total | #,###.2 |

Top Country Weightings

% of Total Investments as of April 30, 2025

| United States | 91.57 |

| Israel | 2.83 |

| India | 2.26 |

| United Kingdom | 1.63 |

| Argentina | 0.83 |

| Cayman Islands | 0.55 |

| Canada | 0.34 |

| Total | #,###.2 |

Information provided is not a recommendation to buy or sell any security. Portfolio data is subject to daily change.

Investment Team

Disclosures

Principal Risks

All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. You could lose money on your investment and any of the following risks, among others, could affect investment performance. The following principal risks are presented in alphabetical order which does not imply order of importance or likelihood: Company; Currency; Environmental, Social, and Governance (Equity); Focused Investing; Foreign (Non-U.S.) Investments/ Developing and Emerging Markets; Growth Investing; Health Care Sector (Focused Investing); Investment Model; Liquidity; Market; Market Disruption and Geopolitical; Other Investment Companies; Securities Lending; Small-Capitalization Company; Technology Sector (Focused Investing). Investors should consult the Fund’s Prospectus and Statement of Additional Information for a more detailed discussion of the Fund’s risks.

The fund discussed may be available to you as part of your employer sponsored retirement plan. There may be additional plan level fees resulting in personal performance that varies from stated performance. Please call your benefits office for more information.