Voya has been offering separately managed accounts to high-net-worth investors since the early ’80s, combining the advantages of owning individual securities with the expertise of institutional money management.

Advantages of SMAs

- Customization:1 SMA investors own individual securities rather than a slice of a mutual fund, allowing managers to tailor portfolios to an investor’s preferences and goals. For instance, an investor who owns a lot of company stock can minimize further exposure to the sector, or they may want a portfolio that aligns with their values, avoiding certain industries altogether.

- Tax efficiency: SMA managers may be able to offset capital gains by selling other securities at a loss through a process known as tax-loss harvesting.

- Insulation: Unlike mutual funds, SMAs are unaffected by the buying and selling activity of other shareholders, which may reduce returns.

What we offer

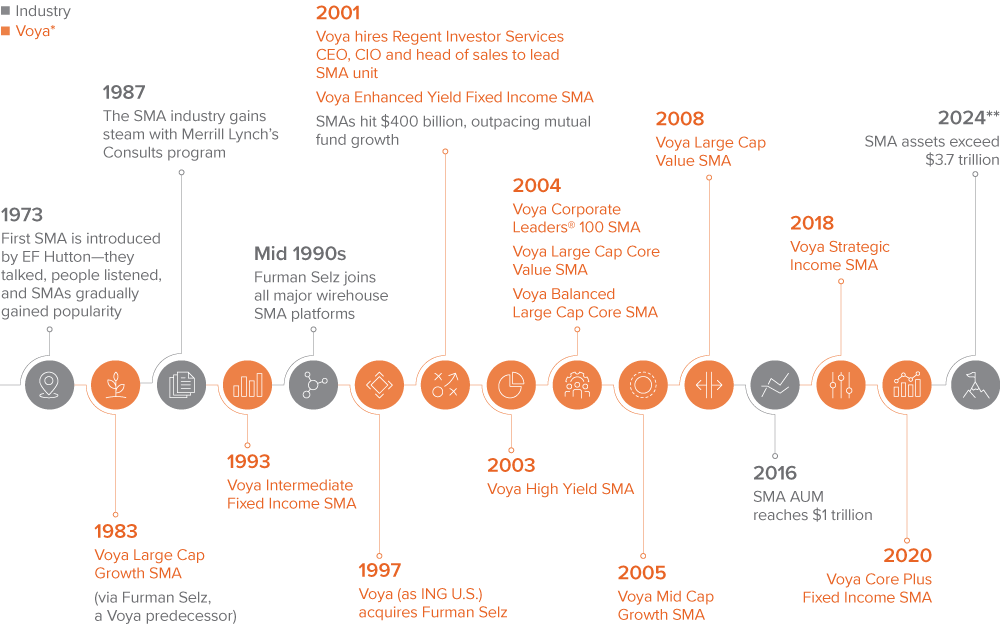

Voya was among the earliest to offer managed accounts, launching our first SMA in 1983 through Furman Selz Capital Management, a Voya predecessor. Since then, we’ve delivered additional fixed income and equity managed accounts.

We manage SMAs the same way we do our mutual funds—the same investment teams, the same underlying philosophies, the same portfolio construction processes—avoiding unwanted divergence in performance. This philosophy has underpinned our ability to deliver long-term success for our SMA clients.

As of 09/30/24.

Source: Cerulli Associates; Voya IM; Sydney LeBlanc, “Legacy: The History of Separately Managed Accounts.”

* Product availability depends on platform.

**Assets through 3Q24.

Ask your Voya sales representative for Voya SMAs available on your platform or call 1-800-334-3444. |